The IRS Form 1040 is one of the most common IRS tax forms in use today and is required to be filled in by individuals to file their tax returns with the IRS. The form is applicable to all U.S. taxpayers who file their taxes as an individual and is officially titled “IRS Form 1040 - Individual Income Tax Return.” Here, we'll tell you about where to download 1040 form PDF, how to fill it out and common mistakes to avoid.

Form 1040 Revision in 2020

Prior to 2018, the IRS had multiple variants of the Form 1040 and you had to choose the correct one on your own to file your taxes. Thankfully, the IRS changed this in 2018 and there’s only one IRS form 1040 that is applicable to all individuals filing their taxes in the U.S. IRS Form 1040A and IRS Form 1040EZ are no longer used or required by the IRS.

The 2020 Revision of the Form 1040 also made changes to the six numbered schedules (Schedule 1 to Schedule 6) available in addition to the base form. Now there are three schedules — Schedule 1, Schedule 2, and Schedule 3 — each of which is split into Part I and Part II. Depending on which conditions are applicable to you, you need to fill out the additional schedules too: https://www.irs.gov/forms-pubs/about-form-1040.

2026 Form 1040 revisions

For the 2026 tax filing season, the Form 1040 is updated with significant changes:

- New Schedule 1-A (Additional Deductions): Used for claiming new deductions under the OBBBA, including tax-free tips, overtime, and car loan interest.

- New expanded benefit for 65+: an additional $6,000 per person deduction. Form 1040-SR is available as an optional alternative for taxpayers who are age 65 or older.

- Digital assets: Taxpayers must report crypto, NFT, or stablecoin transactions (effective for 2025 transactions) using the new Form 1099-DA.

- Permanency for previously-expiring income bracket rates.

- Standard deduction amount increased for all filers:

- $16,100–Single or Married filing separately.

- $32,200–Married filing jointly or Qualifying surviving spouse.

- $24,150–Head of household.

- A larger child tax credit: for 2025, the maximum CTC has increased to $2,200 per qualifying child, of which $1,700 can be claimed for the ACTC.

- Direct deposit changes: the IRS recommends paying electronically whenever possible and use direct deposit for any refunds.

For the full list of updates and changes, visit the IRS website.

When do I need the IRS 1040 Form?

You need to file the IRS Form 1040 if you are a U.S. resident making your earnings as an individual and want to file your tax returns with the IRS. The details that you fill out on the form PDF helps to calculate the correct amount of taxes that you need to pay to the IRS and in some cases, helps to calculate if any refunds are owed to you.

Let’s read more about how to fill up the Form 1040 and also take a quick look at the IRS Form 1040 instructions.

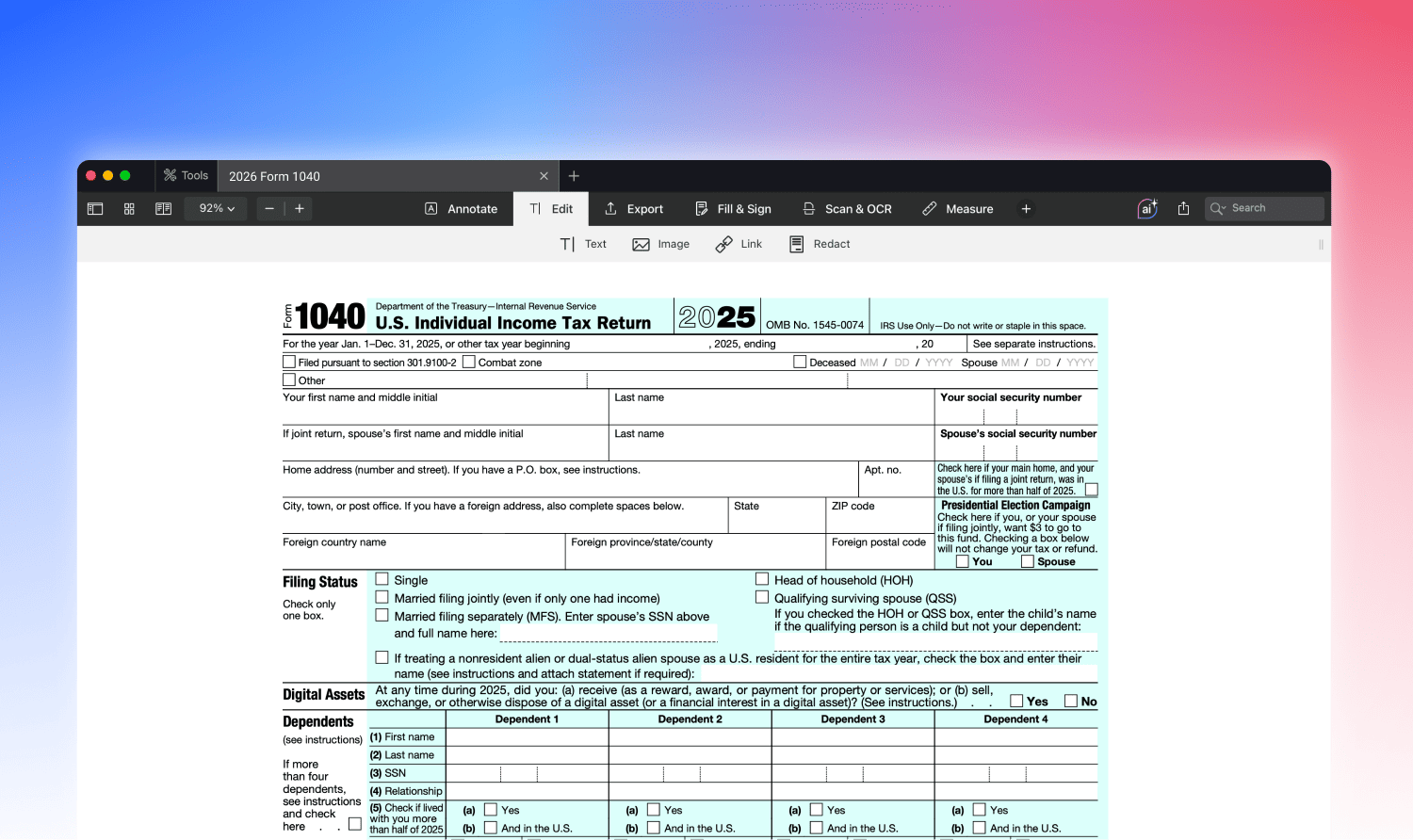

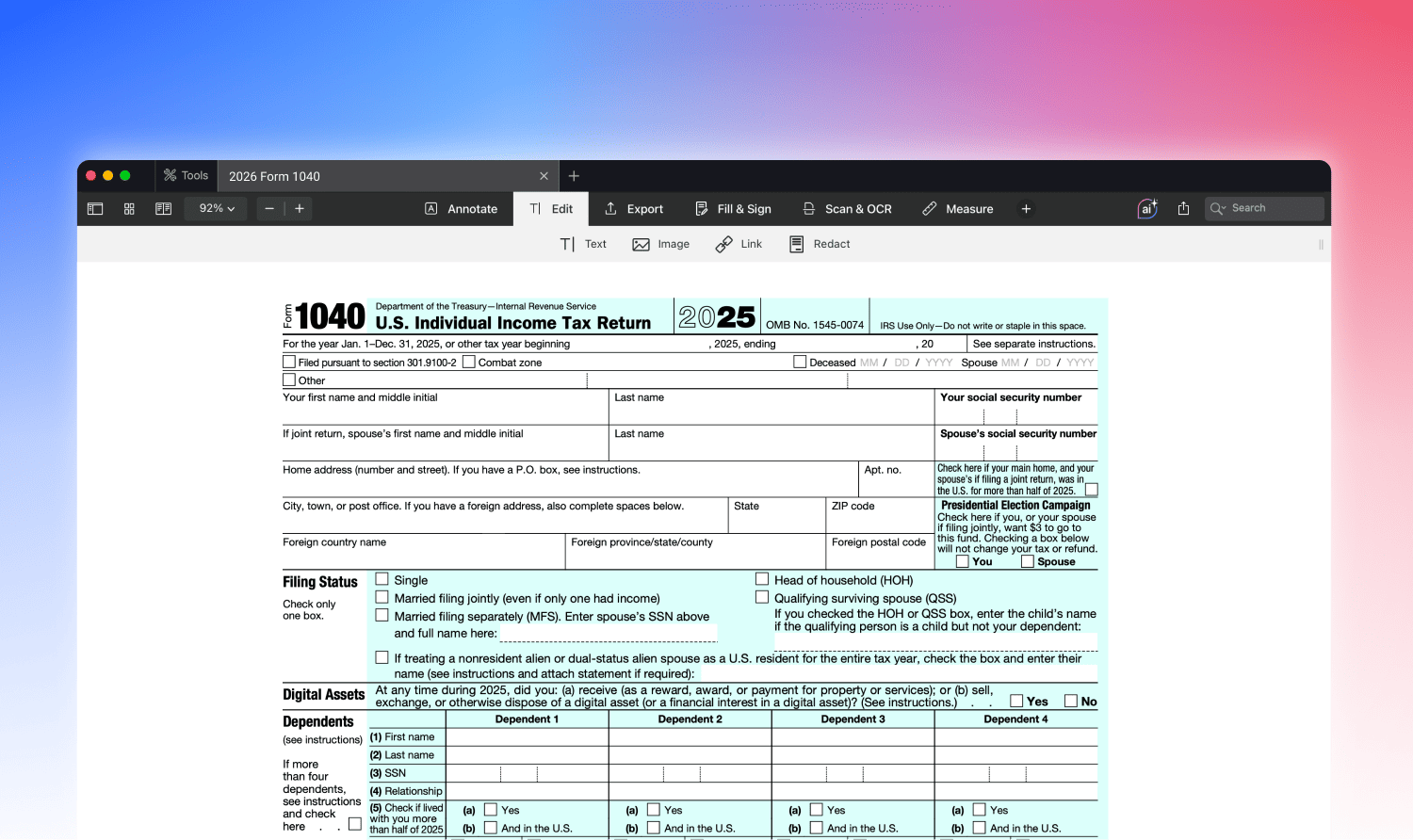

How to fill 1040 Form on Mac?

It is very easy to fill out the Form 1040 on a Mac. Just follow our simple instructions to fill form 1040 and you’ll be on your way in no time.

- Download the official IRS Form 1040 from here.

- Install PDF Expert on your Mac and open the downloaded form

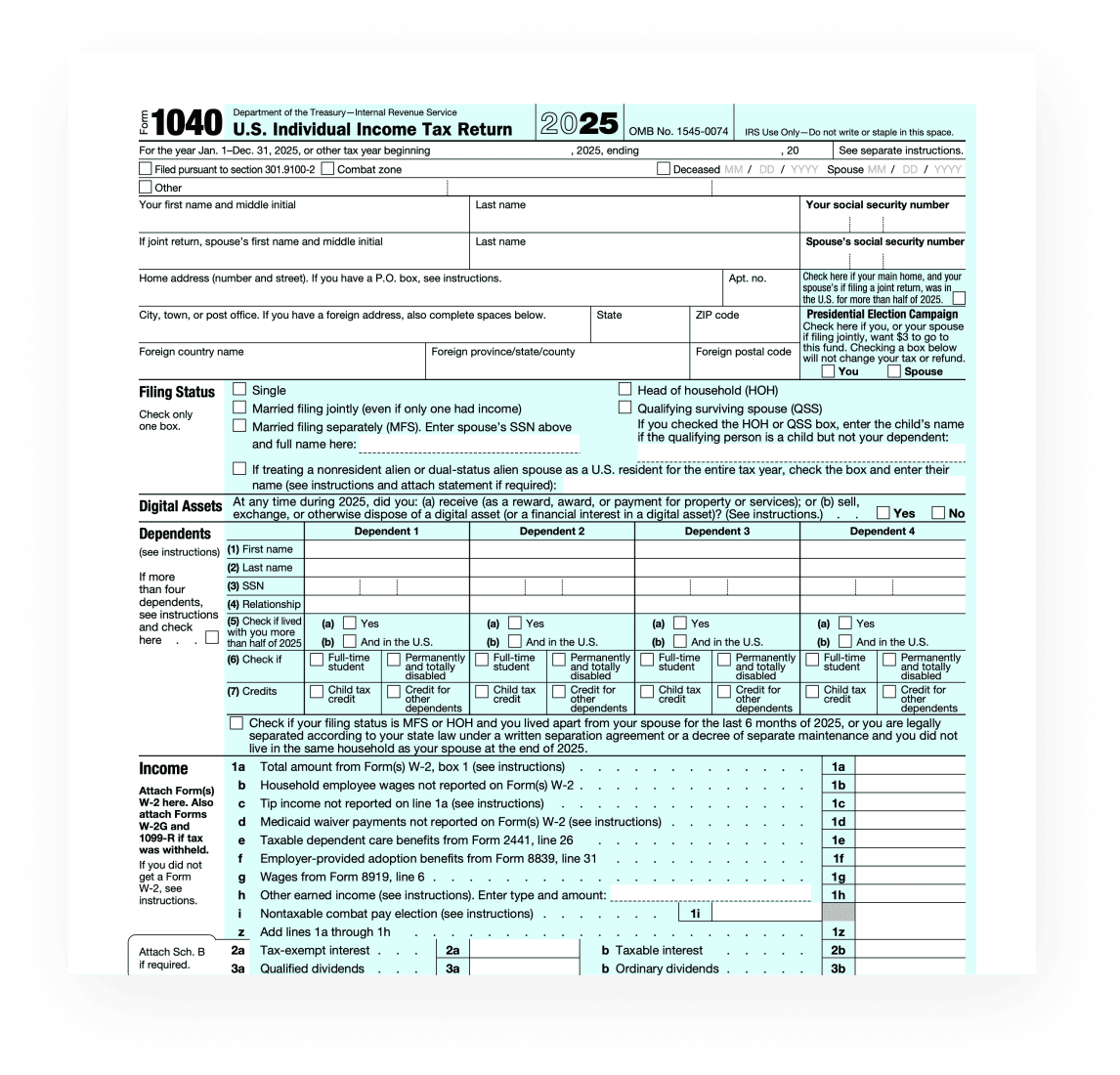

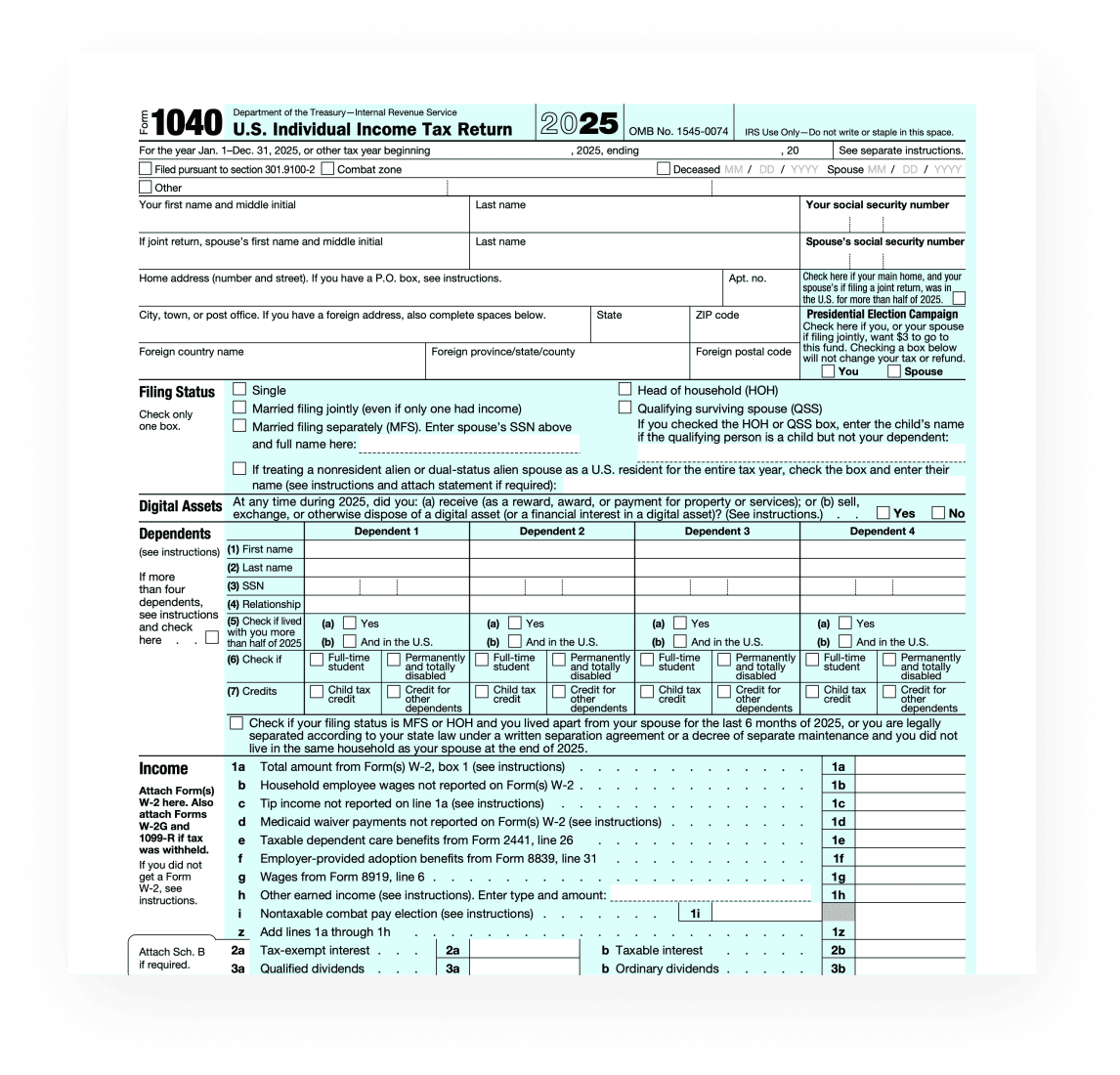

- Select the correct option for Filing status and using Type tool, fill in your name, address, and Social Security number (SSN) next to all the respective labels on page 1. If you’re filing jointly, you also need to add the name and SSN of your spouse. If you have kids or other dependents, you need to add the names, SSNs and the relationship (to the filer) of each dependent.

- Then, enter the correct values for sr. no. 1 to 38. For lines 1 through 7 you can use your W-2 form, to get your income information from it.

- You should also enter information on other sources of income: any interest, dividends, pensions, annuities, individual retirement account (IRA) distributions or Social Security benefits. Using all of the above, calculate and enter your adjusted gross income (AGI) on Line 8b.

- No 37 are your form 1040 total tax payments to IRS, No. 19 is the amount of tax you overpaid (if calculated), and No. 22 is the amount of tax you still owe to the IRS (if calculated).

- Save the form, sign it and send it to the IRS.

What are the IRS 1040 Tax Form due dates?

The due dates for the 1040 tax form for 2025 are fast approaching, so you must make sure that you are ready with your copy of IRS Form 1040 with all information duly filled in. File Form 1040 by April 15, 2026.

Common Mistakes When Filling Up IRS Form 1040

When it comes to filling our complex forms, it’s easy to make mistakes. Especially when it comes to something as important as your tax forms. Here are some common mistakes you can avoid when you are trying to fill out the IRS Form 1040.

- Wait until you have all proper tax reporting documents before filing your 1040 Form. Filing prematurely is just as risky as filing late.

- Check if you choose the correct filing status (e.g. if you got married recently). The Interactive Tax Assistant on IRS.gov can help taxpayers choose the correct status, especially if more than one filing status applies.

- Ensure that the Names and Social Security Numbers (SSNs) are entered correctly for yourself as well as all your dependents in the Dependents section.

- Ensure that you do all the calculations correctly. Many tax returns are rejected due to improper methods used to calculate the tax.

- Ensure that you have attached all necessary forms, such as Form(s) W-2, W-2G, or 1099-R.

Sample Preview of How to Fill 1040 Tax Form

What is IRS Form 1040-ES 2026 for?

Once again, make sure you provide accurate information on your IRS Form 1040. If you are unsure of some items, always consult your financial adviser.

The IRS Form 1040-ES 2026 is a variation of the 1040 tax form that is used for filing your Estimated Tax. If you earn any type of income where there is no tax withheld, typically seen in self-employed professions or income from interest, dividends, rents, alimony, etc. then you are required by the IRS to pay estimated tax using form 1040-ES.

The 1040-ES Tax Form contains a worksheet using which you can calculate your Estimated Tax. The form also comes with four payment vouchers that every taxpayer must use to make their payments.

Download PDF Expert for Free and get started with your 2025-2026 Form 1040-ES.

How does PDF Expert Help with filling out tax forms?

PDF Expert is the best PDF editor for Mac with many fantastic features. PDF Expert makes it very easy to fill out your tax forms and save them for handy access later. It contains tools to let you quickly enter information or make corrections in PDF when needed. As the tax season approaches, make sure you download PDF Expert for some peace of mind.

Make sure you provide accurate information on your IRS Form 1040. If you are unsure of some items, always consult with your financial adviser.

PDF Expert does not offer any tax advice, and it is strongly recommended that you seek consultation with a qualified tax expert concerning your specific tax inquiries. To the fullest extent permitted by law, PDF Expert presents this material on an “as-is” basis. PDF Expert hereby disclaims and makes no representation or warranty of any kind, whether express, implied, or statutory, including but not limited to representations, guarantees, or warranties, fitness for a particular purpose, or accuracy.