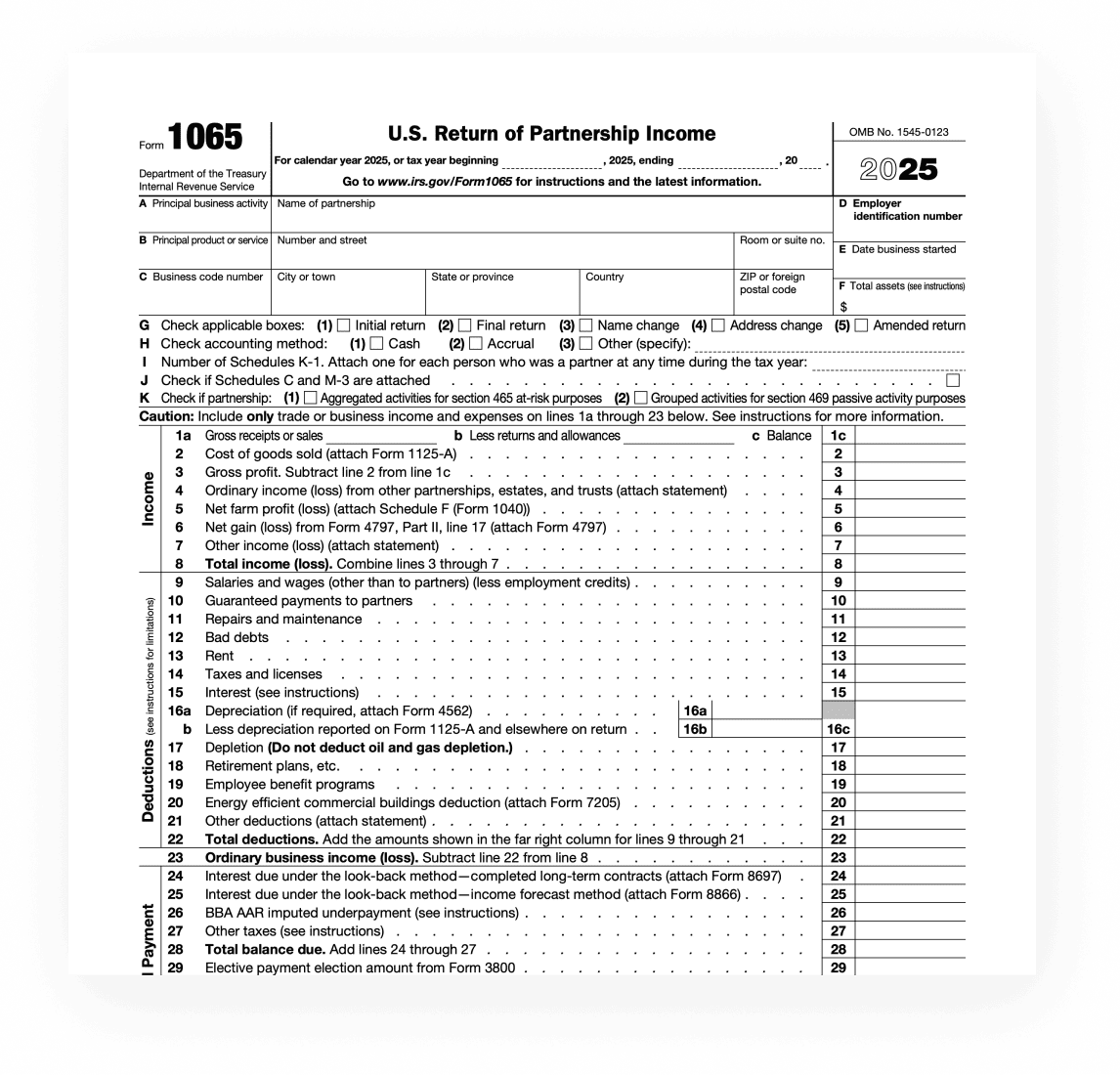

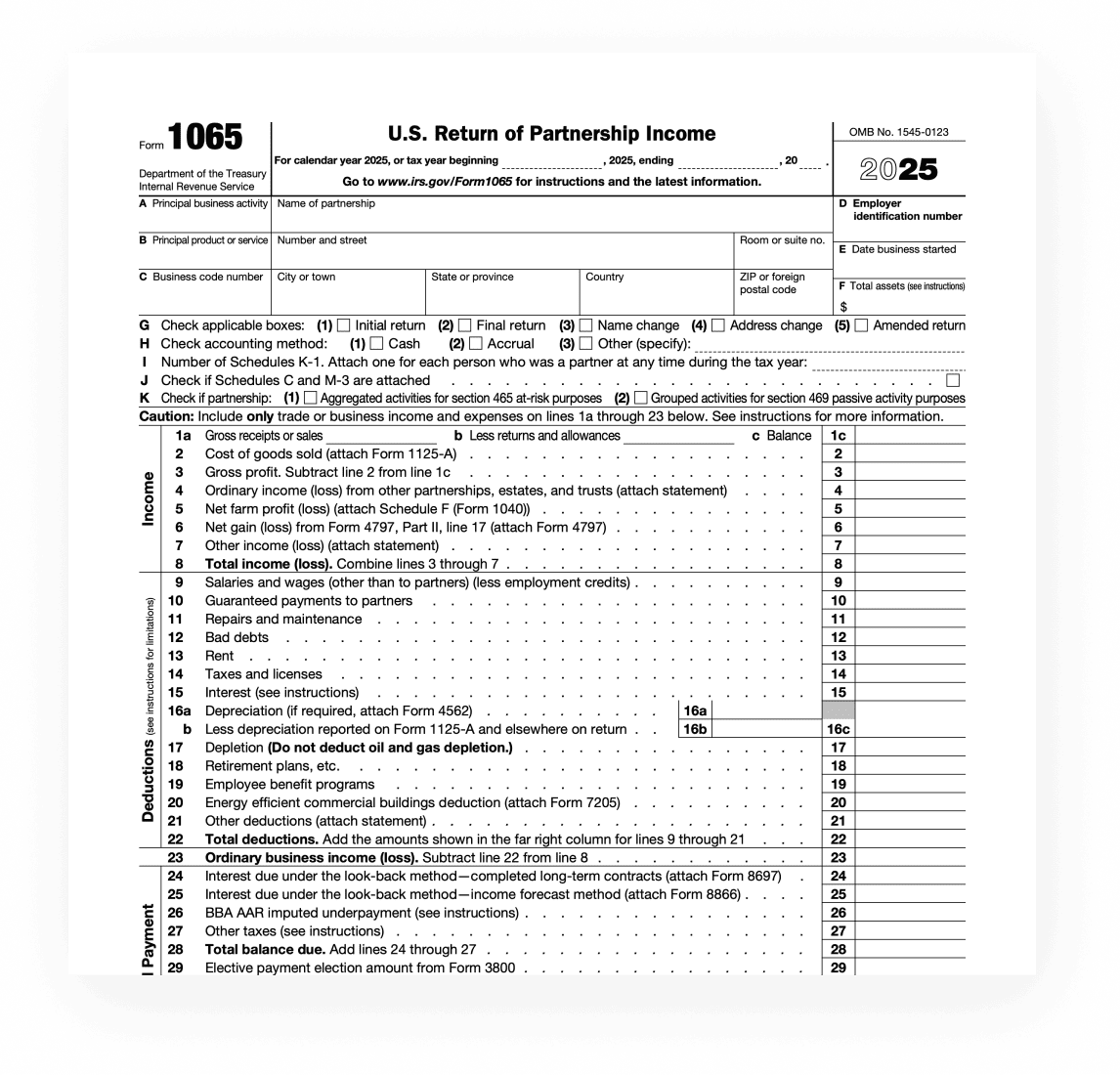

What is IRS Form 1065? It is a U.S. Return of Partnership Income, a tax document required for domestic partnerships to report their income, gains, losses, deductions, credits, and other financial information. This form helps the IRS assess the partnership's tax obligations and ensures that partners report their share of the partnership's income or loss on their personal tax returns. Form 1065 is essential for partnerships because it operates on a "pass-through" taxation principle, where the partnership itself does not pay income tax. Instead, the profits and losses are passed through to the individual partners.

When do I need the IRS 1065 Form?

Form 1065 must be filed annually by domestic and foreign partnerships. This includes any entity classified as a partnership for federal tax purposes, such as multi-member LLCs that have not elected to be treated as a corporation. The deadline for filing Form 1065 is the 15th day of the third month after the end of the partnership's tax year, typically March 15 for partnerships operating on a calendar year.

How to download Form 1065?

To download Form 1065:

- Visit the IRS website at www.irs.gov.

- Navigate to the "Forms, Instructions & Publications" section.

- Search for "Form 1065" and select the relevant tax year.

- Download the form in PDF format for use.

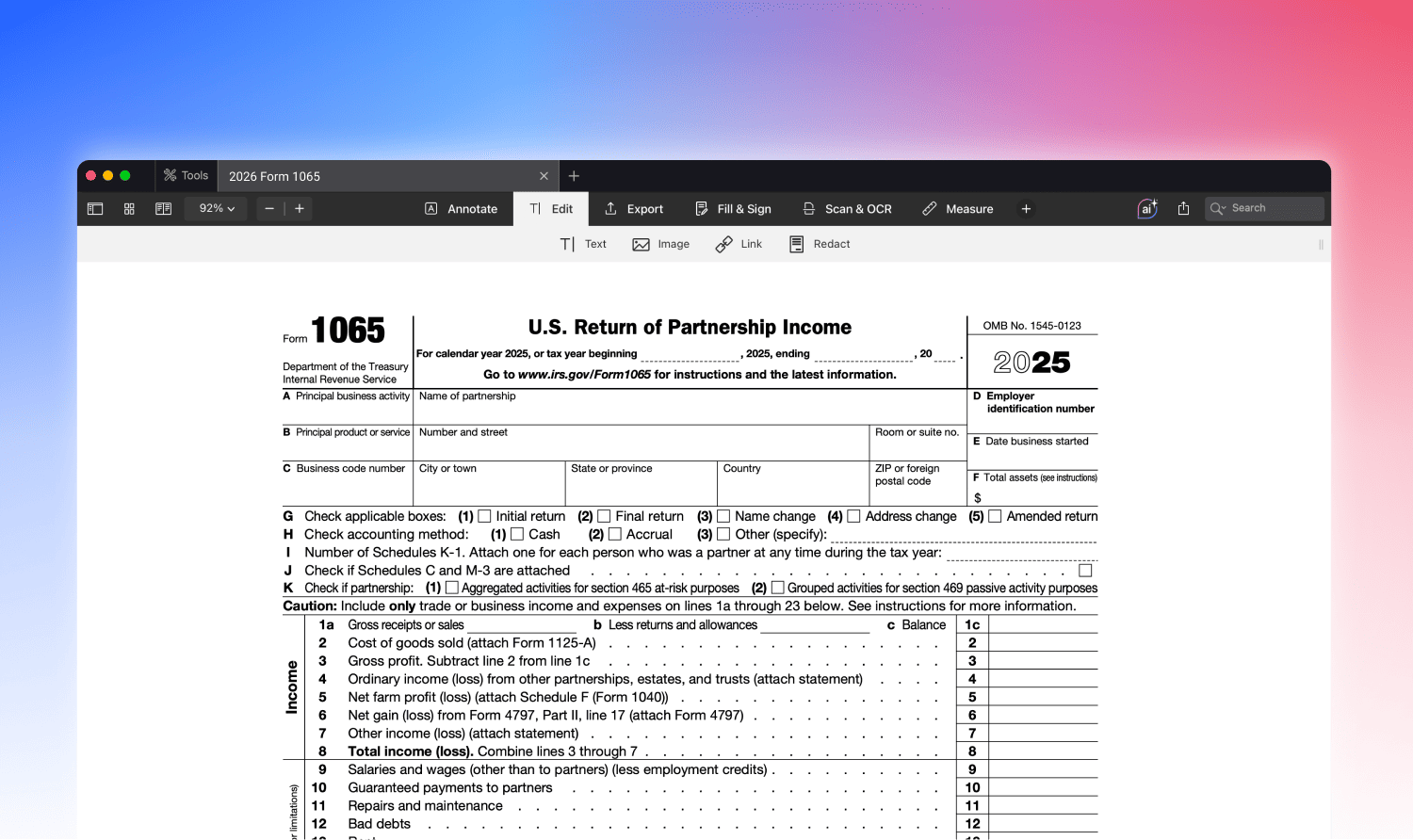

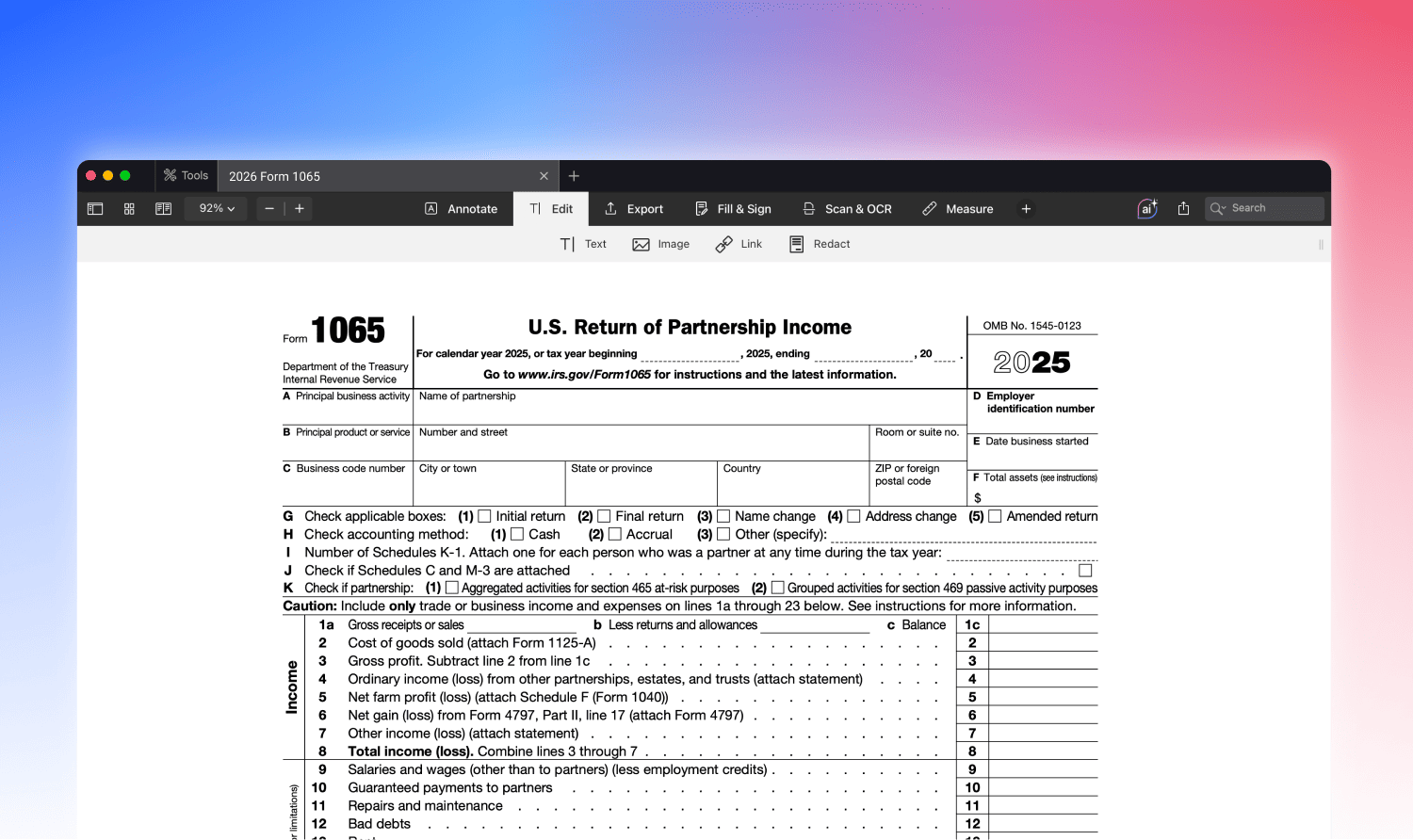

How to fill IRS Form 1065 on Mac?

Follow simple instructions to fill out Form 1065 on a Mac:

Follow simple instructions to fill out Form 1065 on a Mac:

- Open the PDF: Use a compatible PDF reader that allows for form filling and editing (like PDF Expert).

- Enter information: Start with the basic partnership information, including name, address, and Employer Identification Number (EIN).

- Complete schedules: Carefully fill out the required schedules that detail the partnership's income, deductions, and distributions to partners.

- Review for accuracy: Ensure all financial information matches the partnership's records and accounting.

- Sign and date: The form must be signed by a partner or LLC member who is authorized to sign the return.

Key 2026 Updates and Information for Form 1065 (2025 Tax Year):

- The due date for Form 1065 and Schedule K-1 is March 16, 2026 (since March 15 falls on a Sunday).

- Qualified Business Income deduction made permanent: partners can continue claiming up to 20% of QBI on their individual returns.

- It is now required of partnerships to disclose on Form 1065 and Schedule K-1 whether the entity had gross receipts from a Specified Service Trade or Business (including healthcare, law, accounting, financial services, etc.)

For full details of recent changes to the 1065 Form, please visit the IRS website.

Common mistakes to avoid when filling up IRS Form 1065

When completing Form 1065, avoid these common errors:

- Incorrect or incomplete information: Ensure all required fields, especially identification numbers and financial details, are accurately filled.

- Failing to include required schedules: Form 1065 requires various schedules and attachments. Missing any required documents can lead to processing delays or audits.

- Miscalculating income or deductions: Double-check all financial calculations for accuracy.

- Late filing: Submit the form by the deadline to avoid penalties.

How does PDF Expert Help with filling out tax forms?

PDF Expert can significantly simplify the process of completing Form 1065 on a Mac. Its intuitive interface allows users to navigate and enter information into the form easily. The software's annotation features allow you to note important information or questions for a tax advisor. Additionally, PDF Expert supports electronic signatures, enabling authorized partners to digitally sign the form before submission. Finally, the form-saving option is handy for keeping records or if the completion process needs to be paused and resumed later.

Using PDF Expert, partnerships can efficiently prepare their Form 1065, ensuring accuracy and compliance with IRS requirements.

PDF Expert does not offer any tax advice, and it is strongly recommended that you seek consultation with a qualified tax expert concerning your specific tax inquiries. To the fullest extent permitted by law, PDF Expert presents this material on an “as-is” basis. PDF Expert hereby disclaims and makes no representation or warranty of any kind, whether express, implied, or statutory, including but not limited to representations, guarantees, or warranties, fitness for a particular purpose, or accuracy.

Follow simple instructions to fill out Form 1065 on a Mac:

Follow simple instructions to fill out Form 1065 on a Mac: