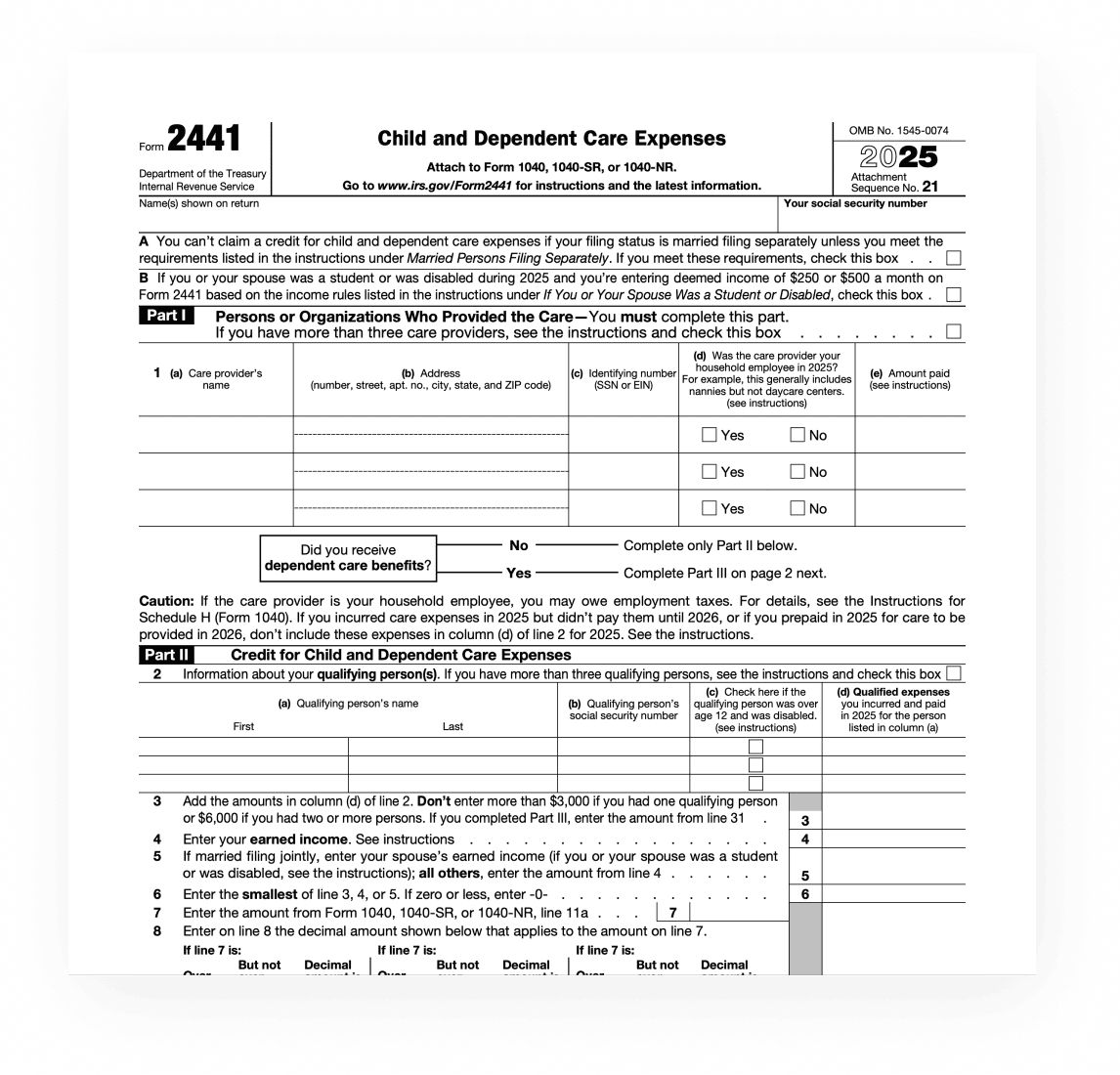

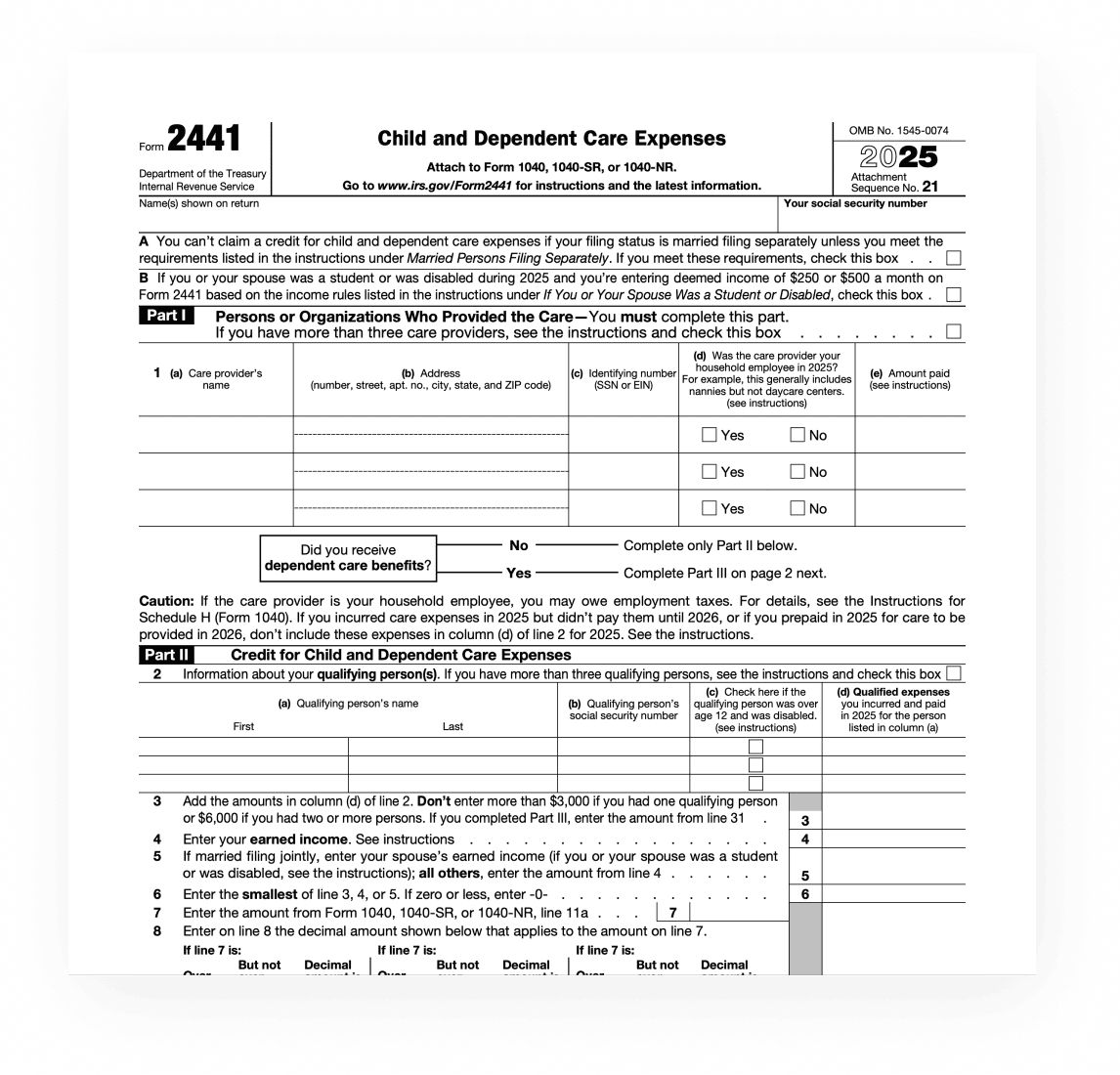

Form 2441 is an IRS tax form used by taxpayers to claim a credit for child and dependent care expenses. This credit is designed to offset the cost of childcare or the care of a disabled dependent while the taxpayer is working or looking for work. This form is essential for individuals who have paid someone to care for a child under the age of 13, a disabled spouse, or another dependent so that they can work or actively seek employment.

When do I need the IRS 2441 Form?

Filing Form 2441 is necessary when:

- You paid for the care of a qualifying person to allow you (and your spouse, if filing jointly) to work or look for work.

- You have earned income. If you are married, your spouse must also have earned income unless they are a full-time student or disabled.

- You are reporting expenses related to employer-provided dependent care benefits.

What are dependent care benefits?

Dependent care benefits are employer-provided benefits that assist employees with the cost of caring for qualifying dependents while they work. These benefits are typically part of a flexible spending arrangement (FSA) or an employer-sponsored program. Key aspects include:

- Tax Advantages: Payments made through these programs can be tax-free up to a certain limit, reducing taxable income.

- Use for Eligible Expenses: These benefits are used for qualifying expenses, such as daycare, preschool, before or after school programs, and summer camps for children under 13, or for the care of a disabled spouse or dependent.

- Contribution Limits: There is an annual limit on the amount of income that can be set aside or received tax-free for dependent care expenses.

- Claiming the Credit: If you receive dependent care benefits, it's crucial to complete Form 2441 to determine the amount of your tax credit and any taxable benefits.

- Employer Reporting: Employers must report the total amount of dependent care benefits provided to an employee during the year in box 10 of the employee's W-2 form.

Understanding dependent care benefits is essential for accurately completing Form 2441 and maximizing your available tax credits.

How to download 2441 Form?

Form 2441 can be downloaded directly from the IRS website. To obtain the form:

- Visit the IRS website.

- Navigate to the "Forms and Instructions" section.

- Search for "Form 2441" and select the appropriate tax year.

- Download the form in PDF format.

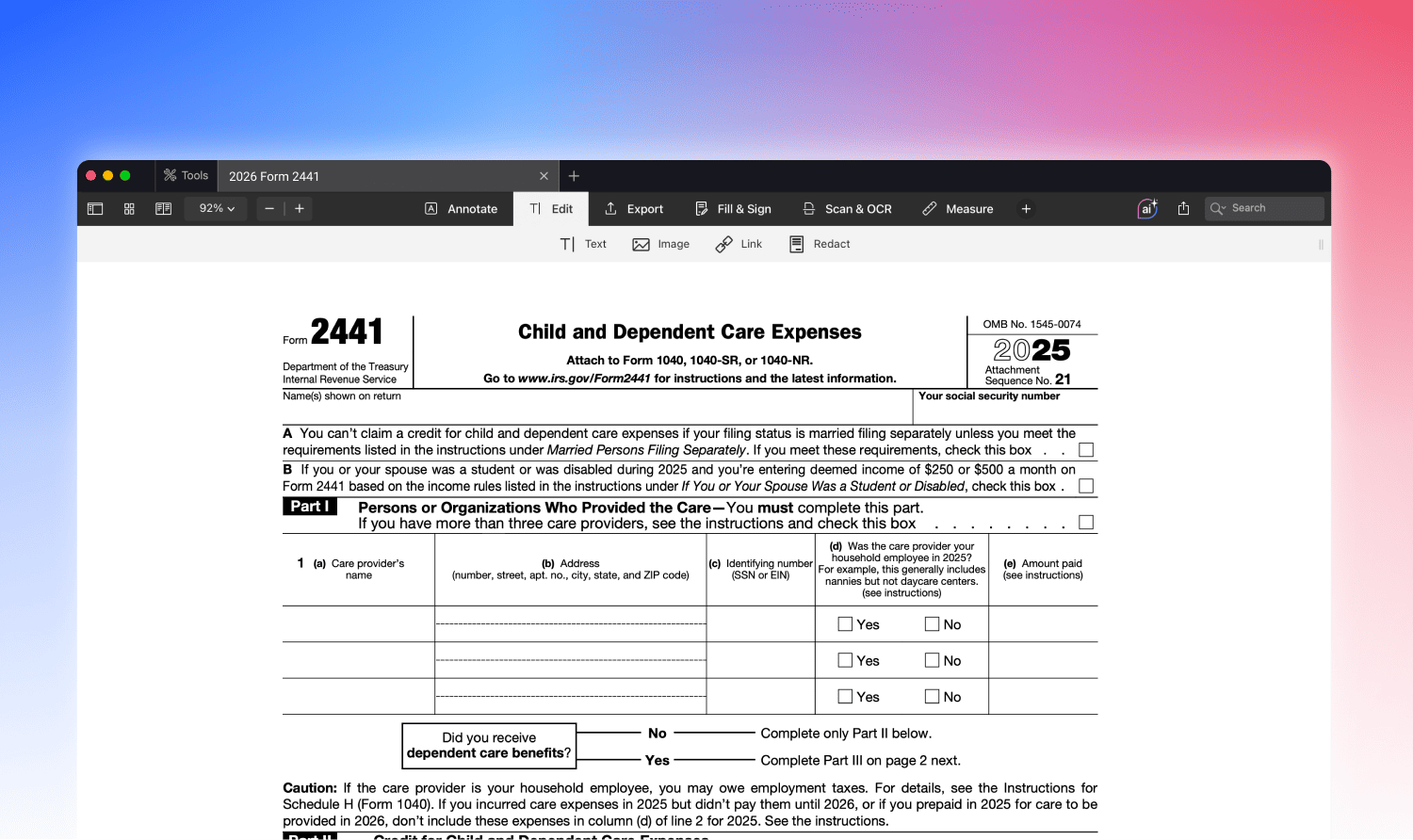

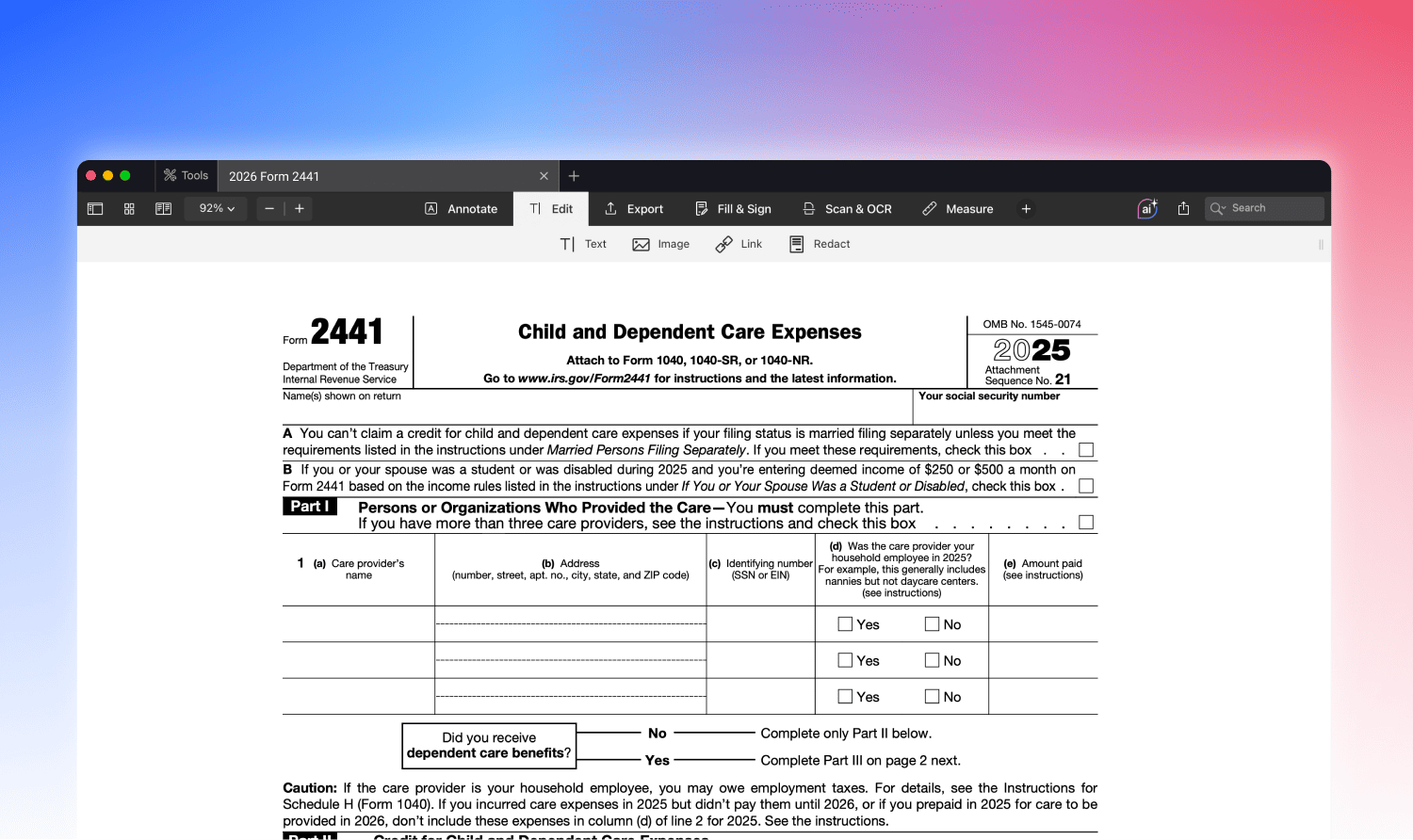

How to fill IRS Form 2441 on Mac?

You can fill out Form 2441 easily on your Mac using a reliable PDF editor. Here are simple instructions:

- Open the downloaded Form 2441 in a PDF editor that is compatible with Mac (like PDF Expert).

- Begin by entering your personal information, including your name and Social Security Number.

- Follow the Form 2441 instructions carefully to fill out the details about your childcare expenses the provider’s information, and calculate the credit.

- Ensure that all calculations are accurate and the information is complete.

- Sign the form and send it out.

Common mistakes to avoid

When completing 2441 form, be mindful of the following common errors:

- Incorrect or Incomplete Provider Information: Ensure the caregiver’s name, address, and Tax ID or Social Security Number are correctly filled.

- Miscalculating Expenses: Accurately calculate allowable expenses; don’t overestimate.

- Filing Status Errors: Ensure your filing status is eligible for the credit.

- Forgetting to Sign: If filing a paper return, don’t forget to sign and date the form.

How does PDF Expert Help with filling out tax forms?

PDF Expert users a streamlined and efficient solution for completing tax forms like Form 2441. It is designed with an intuitive interface that makes it easy to enter and edit information directly on the form. The tool includes features particularly helpful for tax preparation, such as advanced form-filling tools. Additionally, PDF Expert provides annotation tools, allowing users to note important information or clarifications directly on the form, enhancing the clarity and accuracy of the data entered.

Another significant feature of PDF Expert is its electronic signature capability. This feature enables you to digitally sign your forms, making them ready for e-filing or printing, thus streamlining the submission process. Moreover, PDF Expert allows users to save the form, either for future reference or to continue filling out at a later time. This flexibility is particularly useful for managing complex tax documents that require careful review and completion.

Mac users can efficiently and accurately complete Form 2441 by utilizing PDF Expert to ensure they meet IRS requirements and avoid common errors.

PDF Expert does not offer any tax advice, and it is strongly recommended that you seek consultation with a qualified tax expert concerning your specific tax inquiries. To the fullest extent permitted by law, PDF Expert presents this material on an “as-is” basis. PDF Expert hereby disclaims and makes no representation or warranty of any kind, whether express, implied, or statutory, including but not limited to representations, guarantees, or warranties, fitness for a particular purpose, or accuracy.