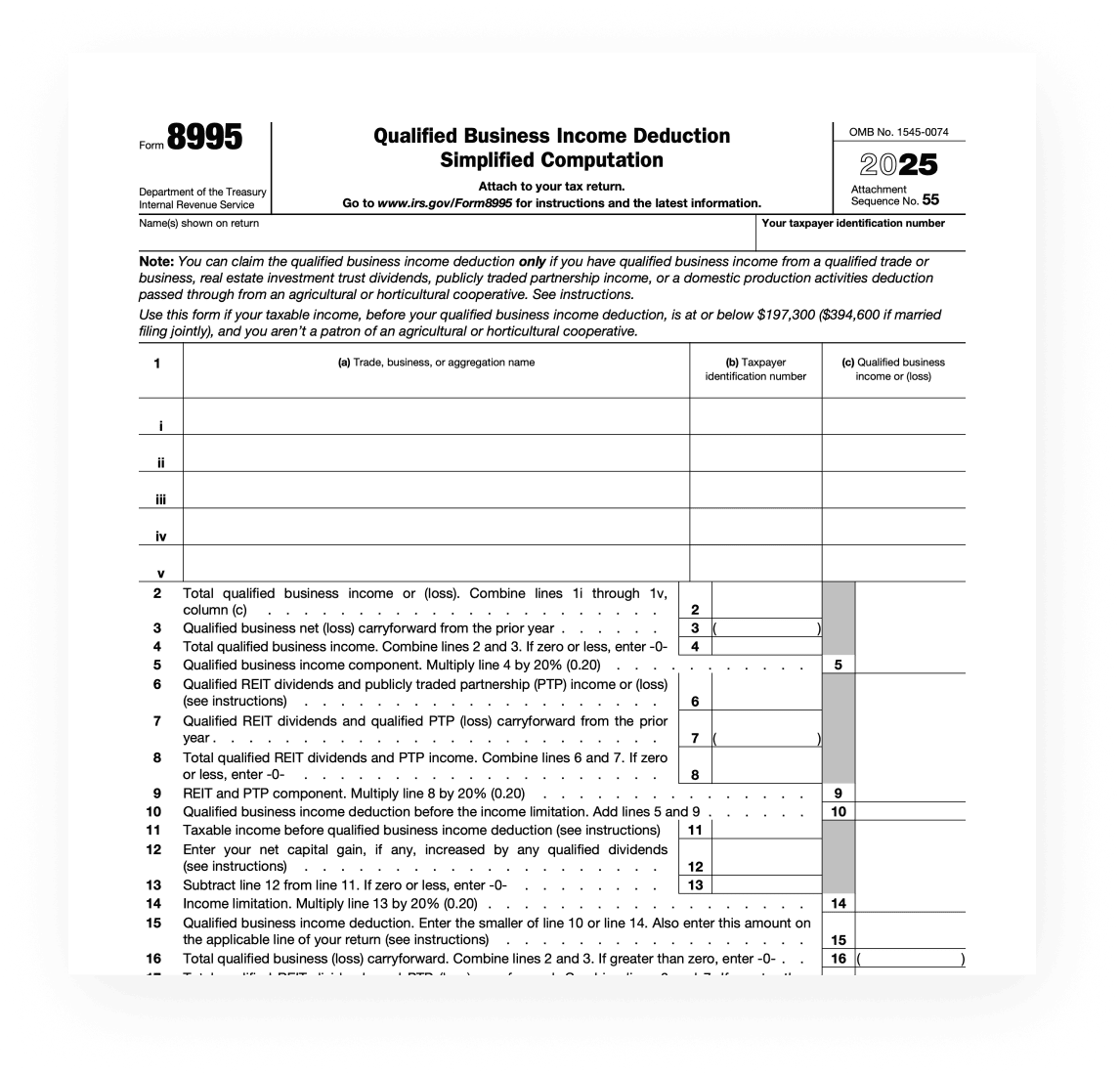

IRS Form 8995 is used for the Qualified Business Income Deduction Simplified Computation. It allows eligible taxpayers, such as sole proprietors, partnerships, S corporations, and some trusts and estates, to calculate and claim the Qualified Business Income (QBI) deduction. This deduction can be up to 20% of qualified business income plus 20% of qualified real estate investment trust (REIT) dividends and qualified publicly traded partnership (PTP) income.

When do you need Form 8995?

If your business is a sole proprietorship, partnership, limited liability company (LLC), or S corporation, you may qualify for a business income deduction. Form 8995 is required for taxpayers with a taxable income below a certain threshold ($197,300 for single filers and $394,600 for joint filers in 2025), simplifying their QBI deduction calculations. Those with higher incomes or more complex situations may need to use Form 8995-A.

What is qualified business income deduction simplified?

The Qualified Business Income Deduction (QBI Deduction), introduced by the Tax Cuts and Jobs Act of 2017, allows eligible self-employed individuals and small business owners to deduct up to 20% of their qualified business income (QBI) from their taxes. This deduction is a significant tax break for small business owners, sole proprietors, and freelancers.

"Simplified" in this context refers to the streamlined method of calculating the deduction, particularly for taxpayers whose taxable incomes fall below a certain threshold. Here’s a basic overview:

- Eligibility Criteria: The simplified calculation is available to taxpayers with taxable incomes below a set threshold ($197,300 for single filers and $394,600 for joint filers in 2025). For those above this threshold, the deduction becomes more complex, involving additional limitations and calculations.

- Qualified Business Income: QBI generally includes the net amount of income, gains, deductions, and losses from any qualified trade or business. This does not include employee wages, capital gains, interest income, and certain other types of income.

- Deduction Calculation: For those eligible for the simplified calculation, the deduction is generally 20% of the QBI from a qualified business or trade. There are no additional calculations for wage limits or the unadjusted basis of qualified property, which are required for higher-income earners.

- Impact on Taxes: The QBI deduction reduces taxable income, potentially lowering the tax bracket and the overall tax burden. However, it does not affect self-employment tax.

The QBI deduction is a valuable tax benefit for eligible small business owners and self-employed individuals, and understanding how to calculate it, especially using the simplified method, can lead to significant tax savings.

How to download Form 8995

To download Form 8995:

- Visit the IRS website at www.irs.gov.

- Go to the "Forms & Instructions" section.

- Search for "Form 8995" and select the correct tax year.

- Download the form in PDF format.

How to fill out IRS Form 8995 on your Mac

You can fill out Form 8995 on a Mac with a reliable PDF editor. Just follow these simple instructions:

You can fill out Form 8995 on a Mac with a reliable PDF editor. Just follow these simple instructions:

- Open the downloaded PDF form in a compatible PDF editor (like PDF Expert).

- Input your personal information, such as name and tax identification number.

- Follow the form's instructions to report your business income and calculate the QBI deduction.

- Double-check all entries for accuracy before saving or printing.

Common mistakes to avoid when filling up IRS Form 8995

- When completing Form 8995, it is important to ensure that you are eligible to use this form, particularly by verifying that your income does not exceed the specified threshold.

- Accurate calculation of the QBI deduction is crucial, and this involves correctly reporting all eligible business income.

- Additionally, be mindful of the limitations on the deduction based on your taxable income.

- Another key point is to remember to attach the completed form to your tax return, as this is a common oversight that can lead to processing delays or errors in your tax assessment.

How does PDF Expert help fill out tax forms?

PDF Expert significantly aids Mac users in filling out tax forms like Form 8995 through its user-friendly interface, which simplifies the process of entering and editing information. The software includes features that are especially helpful for tax preparations, such as tools for filling out forms. Moreover, its annotation capabilities allow users to make important notes and clarifications directly on the form, which enhances accuracy. The electronic signature feature streamlines the process by enabling users to digitally sign their forms, thus preparing them for e-filing or printing.

Finally, the ability to save the form is a convenient option, allowing for the continuation of filling out the form at a later time or keeping it for record-keeping purposes. This comprehensive set of features makes PDF Expert an invaluable tool for efficiently and accurately completing Form 8995, ensuring adherence to IRS requirements, and optimizing tax filings.

By utilizing PDF Expert, Mac users can efficiently and accurately complete Form 8995, ensuring that they meet IRS requirements and avoiding common errors.

PDF Expert does not offer any tax advice, and it is strongly recommended that you seek consultation with a qualified tax expert concerning your specific tax inquiries. To the fullest extent permitted by law, PDF Expert presents this material on an “as-is” basis. PDF Expert hereby disclaims and makes no representation or warranty of any kind, whether express, implied, or statutory, including but not limited to representations, guarantees, or warranties, fitness for a particular purpose, or accuracy.

$197,300 for single filers and $394,600 for joint filers in 2025)

You can fill out Form 8995 on a Mac with a reliable PDF editor. Just follow these simple instructions:

You can fill out Form 8995 on a Mac with a reliable PDF editor. Just follow these simple instructions: