2026 W-4 form changes and updates

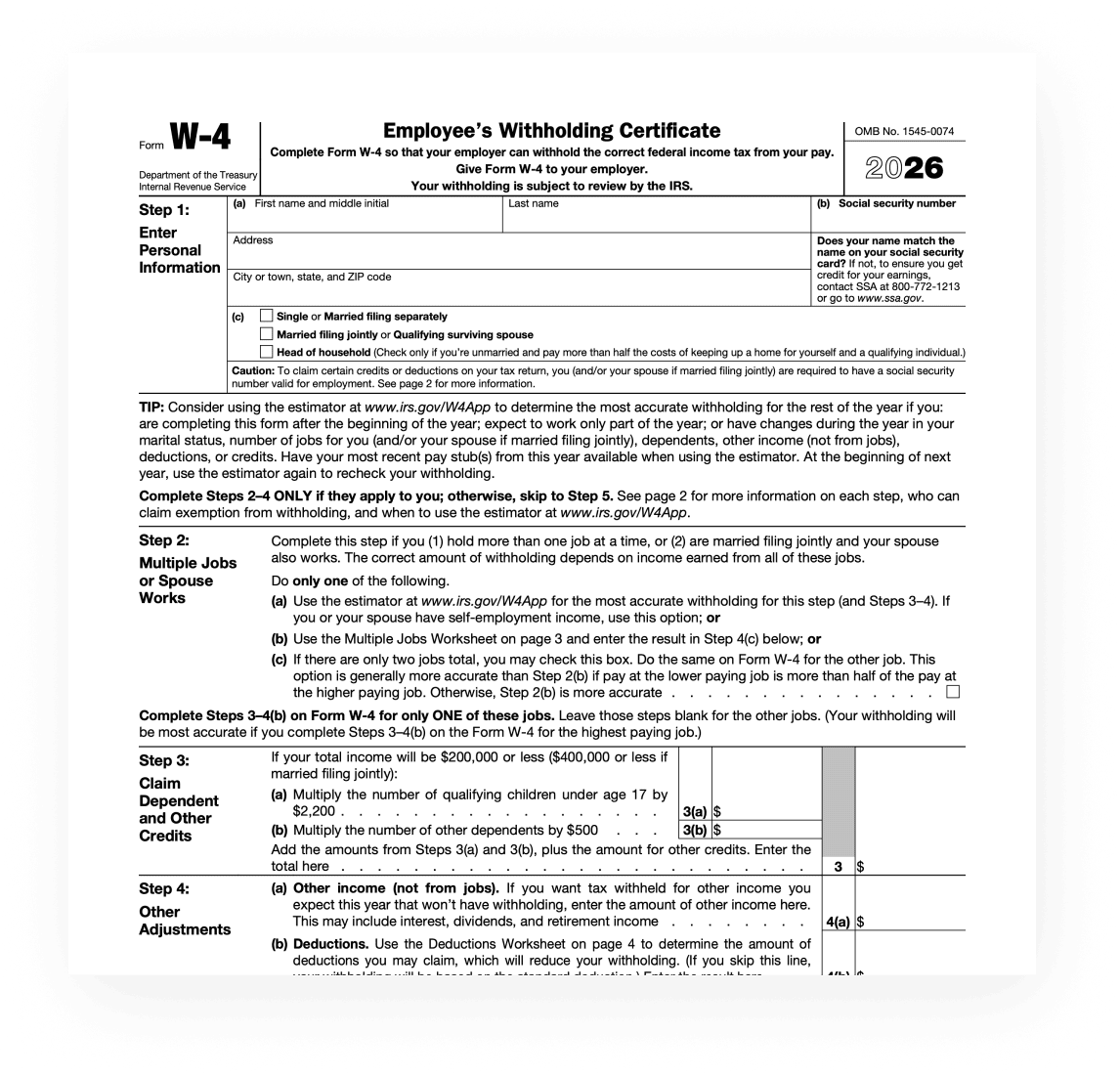

The 2026 IRS Form W-4 contains substantial structural changes due to the One Big Beautiful Bill Act (OBBBA; Pub. L. 119-21). The 2026 Form is expanded to five pages and includes new detailed instructions, a worksheet, and withholding adjustments. Changes include:

- Step 3: Claim Dependent and Other Credits. The layout is updated in Step 3. The OBBBA increased the child tax credit to $2,200 per qualifying child, up from $2,000.

- Step 4: Other Adjustments. Step 4 is no longer labeled as “Optional.” Step 4(b) informs employees that if they skip this line, withholding will be based on the standard deduction.

- Deductions Worksheet. The Deductions Worksheet for Step 4(b) now has 15 lines and is on a separate page.

- New lines were added for employees to enter qualified tips and overtime compensation directly on the form: Line 1(a) for qualified tip income and Line 1(b) for an estimate of qualified overtime compensation.

- Exempt checkbox. A new checkbox after Step 4 allows employees to claim an exemption from withholding, simplifying the process.

For more detailed information on W-4 form updates, visit the IRS website.

Common mistakes to avoid while filling out Form W-4

Mistakes are something we all make. However, mistakes on your tax forms can prove to be costly. Many have found this out the hard way — even a small typo in any of the Name fields could cost you big. That is why we have prepared a list of common mistakes to avoid while you are filling out your Form W-4.

- Misspelling your name or SSN in the W-4 form will most likely result in your employer rejecting it; so make sure the information is entered correctly.

- Proper calculation of the number of deductions is extremely important to avoid surprises during the tax season as you may end up owing money to the IRS. On the other hand, if you overreport your deductions, you will end up with a smaller take-home amount in your paycheck, but a larger tax refund at the end of the year which is like giving the IRS a free loan.

- Make sure you select the correct marital status box as it will also affect the amount of tax withheld from your paycheck.

You should keep all the forms in one place for easy organization, for example in PDF Expert on your iPad or iPhone. This enables you to quickly access the forms whenever you need them.

Once again, make sure you provide accurate information on your W-4. If you are unsure of some items, always consult with your financial adviser.

How does PDF Expert Help with filling out tax forms?

PDF Expert is the best PDF editor for Mac with many fantastic features. PDF Expert makes it very easy to fill out W-4 and other tax forms and save them for handy access later. It contains tools to let you quickly enter information or make corrections in PDF when needed. As the tax season approaches, make sure you download PDF Expert for some peace of mind.

PDF Expert does not offer any tax advice, and it is strongly recommended that you seek consultation with a qualified tax expert concerning your specific tax inquiries. To the fullest extent permitted by law, PDF Expert presents this material on an “as-is” basis. PDF Expert hereby disclaims and makes no representation or warranty of any kind, whether express, implied, or statutory, including but not limited to representations, guarantees, or warranties, fitness for a particular purpose, or accuracy.