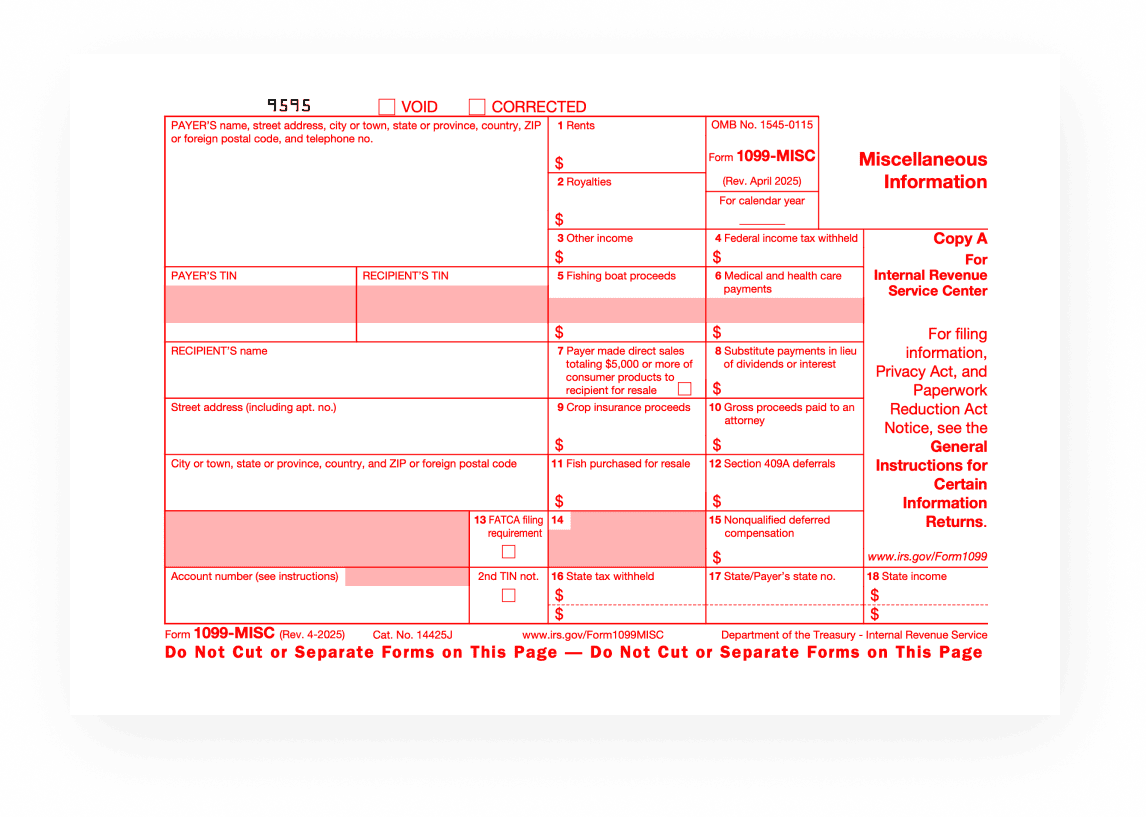

You need to fill out 1099-MISC IRS form if you’re a business or a non-profit based in the US and you have made the following types of payments during the tax year:

- At least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest.

- At least $600 in the following:

- Rents

- Prizes and awards

- Other income payments

- Cash from a notional principal contract to an individual, a partnership or an estate

- Any fishing boat proceeds

- Medical and health care payments

- Crop insurance proceeds

- Payments to an attorney

- Fish purchased for resale

- Section 409A deferrals

- Non-qualified deferred compensation

Also file Form 1099-MISC for each person you withheld federal income tax from under the backup withholding rules (regardless of the payment amount).