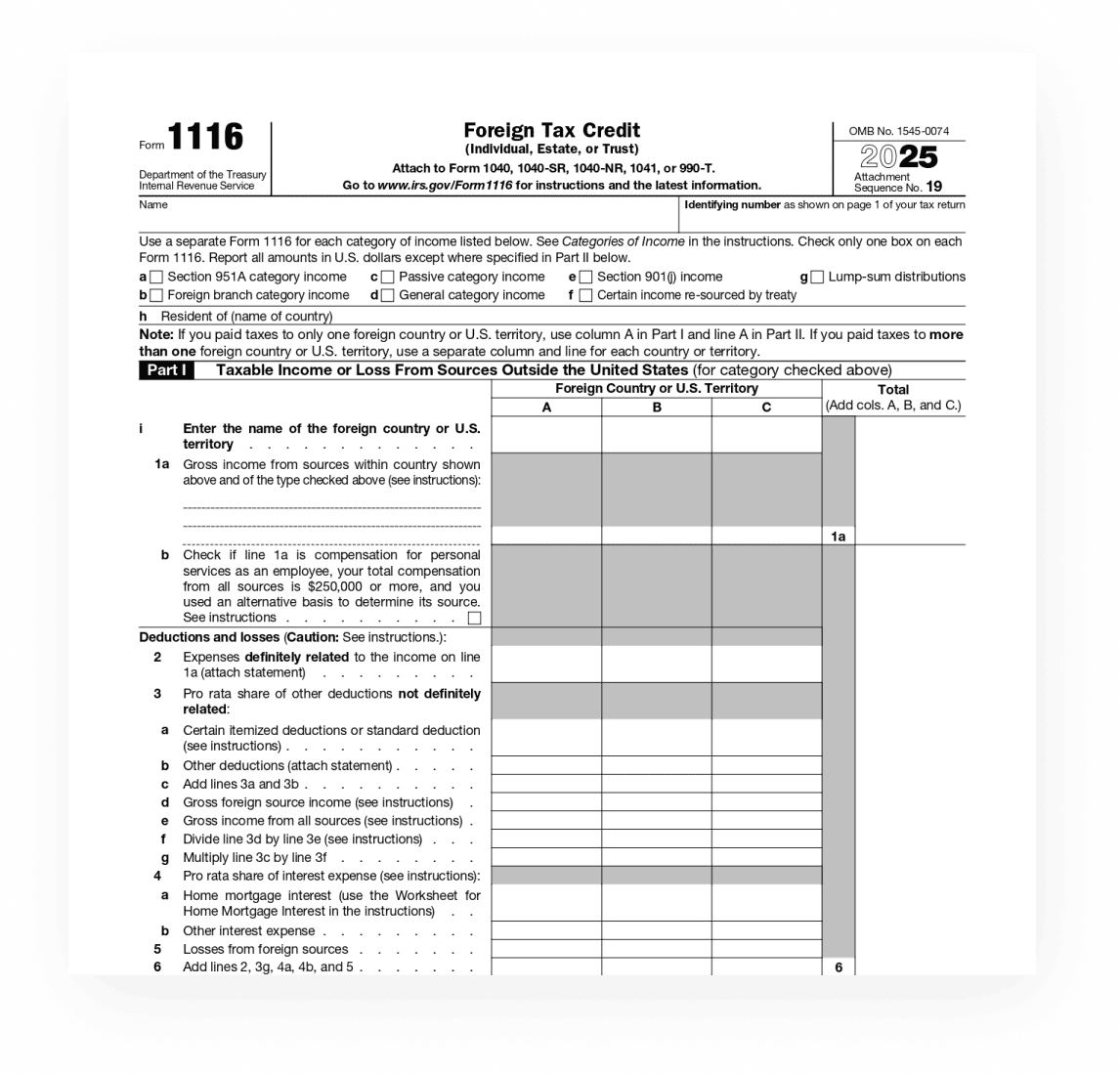

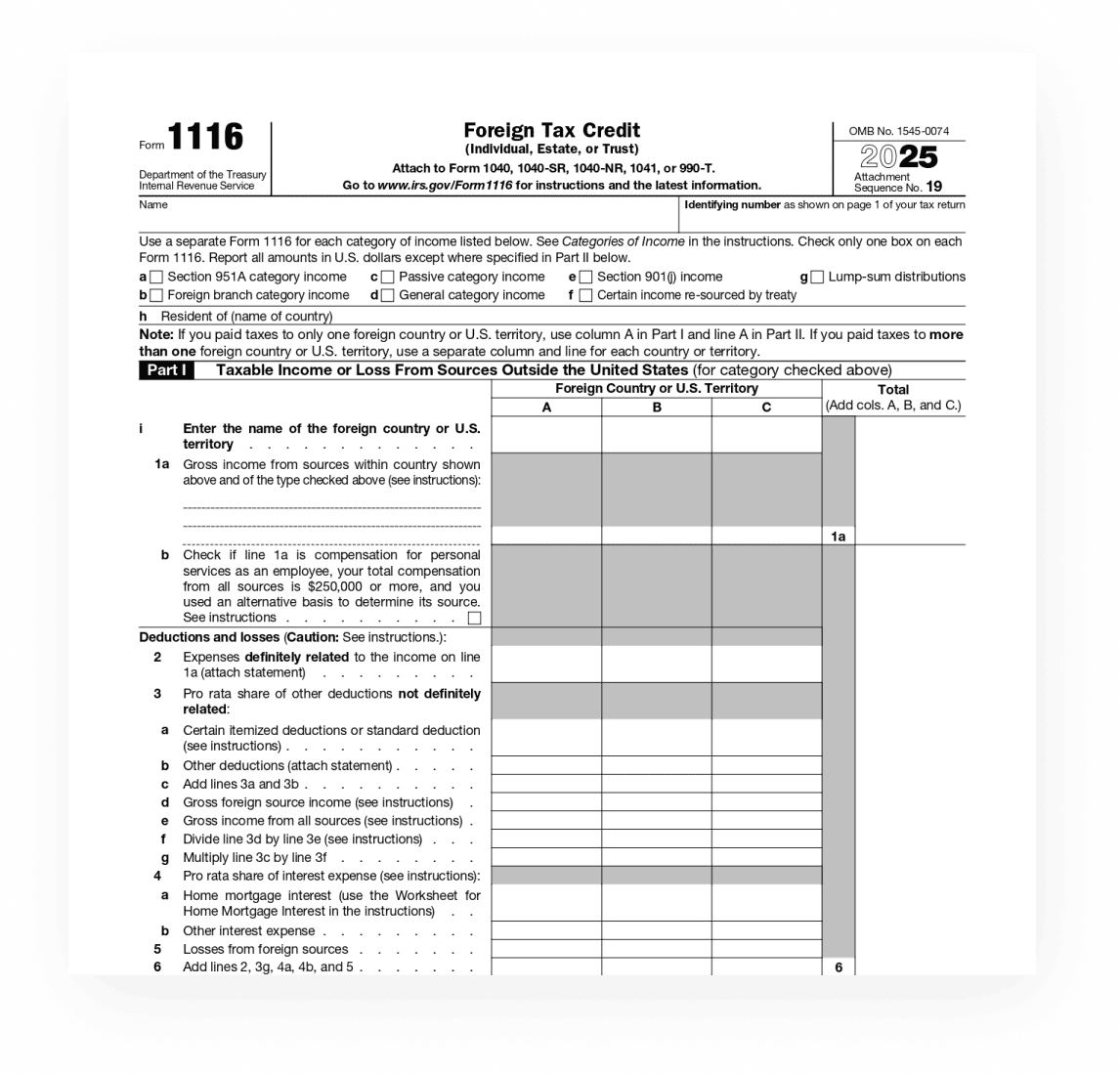

IRS Form 1116, Foreign Tax Credit, is utilized by taxpayers to claim a credit for taxes paid or accrued to a foreign country or U.S. possession. This form is designed to prevent double taxation, allowing U.S. taxpayers to reduce their U.S. tax liability on income that was already taxed by a foreign jurisdiction. The form is applicable for individuals, estates, and trusts that have foreign income and have paid taxes on that income to a foreign government.

When do I need the IRS 1116 Form?

You need to file Form 1116 with your U.S. tax return if you are claiming a credit for income taxes paid to a foreign country or U.S. possession and you are an individual, estate, or trust. This is particularly relevant for taxpayers with foreign-earned income, foreign passive income, or those who have paid foreign taxes on dividends, interest, or other income from foreign sources.

Do I need to file Form 1116 to claim the foreign tax credit?

In many cases, you might not need to file Form 1116 to claim the foreign tax credit if certain conditions apply. Here's a general guideline:

- Small Amounts of Foreign Taxes: If the foreign tax you paid is below a certain threshold ($300 for individual filers or $600 for married couples filing jointly), you may claim the foreign tax credit without filing Form 1116, directly on your Form 1040.

- Type of Income: The credit without Form 1116 is generally limited to taxes paid on passive income such as dividends or interest. If your foreign income includes earned income or other types of foreign income, filing Form 1116 is necessary to calculate and claim the credit accurately.

- Simplification: Not filing Form 1116 simplifies the process but may limit the amount of credit you can claim. For larger amounts of foreign taxes paid or for more accurate computation of the credit, especially where different types of income or various limitations are involved, filing Form 1116 is advisable.

- Eligibility Criteria: To bypass Form 1116, you must meet specific IRS criteria regarding how much tax you paid and the type of income it was paid on. It's also essential that the foreign tax qualifies for the credit and that it was a legal and actual foreign tax liability that you paid or accrued.

- Consider Professional Advice: Given the complexities of the foreign tax credit and the potential for significant tax savings, consulting with a tax professional can help determine whether you can claim the credit directly on your 1040 or if you should file Form 1116 to maximize your benefits and remain compliant with IRS rules.

Remember, the decision to file Form 1116 depends on your specific tax situation, the amount of foreign tax paid, and the nature of your foreign income. Reviewing the IRS instructions for Form 1116 and possibly consulting with a tax professional can provide guidance tailored to your individual circumstances.

Can I skip Form 1116?

Yes, you can choose to skip filing Form 1116 and still claim the foreign tax credit directly on your Form 1040 under certain conditions. This option is typically available if you have paid foreign taxes on passive income, such as dividends or interest, and the amount does not exceed $300 for individual filers or $600 for married couples filing jointly. Additionally, your foreign income and the taxes you paid on it must be reported on a qualified payee statement, such as Form 1099-DIV or Form 1099-INT.

It's also required that the foreign taxes were legally owed, and you're not eligible for a refund or reduction from the foreign country. Importantly, you cannot take credit for taxes paid on income that you've excluded using the foreign earned income exclusion or the foreign housing exclusion. Opting not to file Form 1116 under these specific circumstances simplifies the tax filing process, though it may limit the credit amount to the specified thresholds. If your foreign tax situation is more complex or involves higher amounts of foreign taxes paid, filing Form 1116 could potentially enable you to claim a larger credit. Given the complexities involved in claiming the foreign tax credit, consulting with a tax professional might be advisable to ensure you're maximizing your tax benefits while remaining compliant with IRS regulations.

How to download 1116 Form

To download Form 1116:

- Access the IRS website at www.irs.gov.

- Look for the "Forms & Instructions" section.

- Enter "Form 1116" in the search box and select the applicable tax year.

- Click to download the form in PDF format.

How to fill IRS Form 1116 on Mac?

To fill out Form 1116 on a Mac:

- Open the PDF Form: Use a Mac-compatible PDF reader that supports form editing (like PDF Expert).

- Enter your information: Begin by entering personal information, including your name and identifying number.

- Report foreign income: Fill in the details of the foreign income for which you claim the credit.

- Calculate the credit: Follow the form's instructions carefully to calculate the amount of foreign tax credit. This includes reporting the foreign taxes paid or accrued.

- Review and verify: Double-check all entered information for accuracy and completeness.

2026 updates:

- For the 2026 tax year, the maximum foreign earned income exclusion increases to $132,900, up from $130,000 for 2025.

- The standard deduction for 2026 increases to $32,200 for married couples filing jointly and $16,100 for single taxpayers.

- A new deduction of $6,000 for taxpayers (and spouses) over 65. This amount must be removed from taxable income when computing the foreign tax credit limitation.

For all changes and updates, please check the IRS website.

Common mistakes to avoid when filling out Form 1116

Completing Form 1116 requires attention to detail. Avoid these common pitfalls:

- Incorrect income reporting: Ensure all foreign income and taxes paid are accurately reported.

- Failing to convert currencies: Report all amounts in U.S. dollars using the correct exchange rate.

- Omitting supporting documentation: Attach all necessary documentation, such as proof of foreign taxes paid.

- Incorrect credit calculations: Carefully follow the form’s instructions to calculate the credit correctly.

How does PDF Expert Help with filling out tax forms?

PDF Expert is an easy-to-use tool for Mac users preparing tax forms, like Form 1116. Its user-friendly interface simplifies entering and editing information directly on the form. Annotation tools allow for highlighting important details or adding notes for clarification. The electronic signature capability facilitates the final step of signing the form, making it ready for e-filing or printing. Additionally, the ability to save the form is crucial for maintaining accurate records and allows for pausing and resuming the completion process as needed.

By leveraging PDF Expert, taxpayers can efficiently and accurately complete Form 1116, ensuring compliance with IRS requirements and maximizing their eligible foreign tax credit.

PDF Expert does not offer any tax advice, and it is strongly recommended that you seek consultation with a qualified tax expert concerning your specific tax inquiries. To the fullest extent permitted by law, PDF Expert presents this material on an “as-is” basis. PDF Expert hereby disclaims and makes no representation or warranty of any kind, whether express, implied, or statutory, including but not limited to representations, guarantees, or warranties, fitness for a particular purpose, or accuracy.