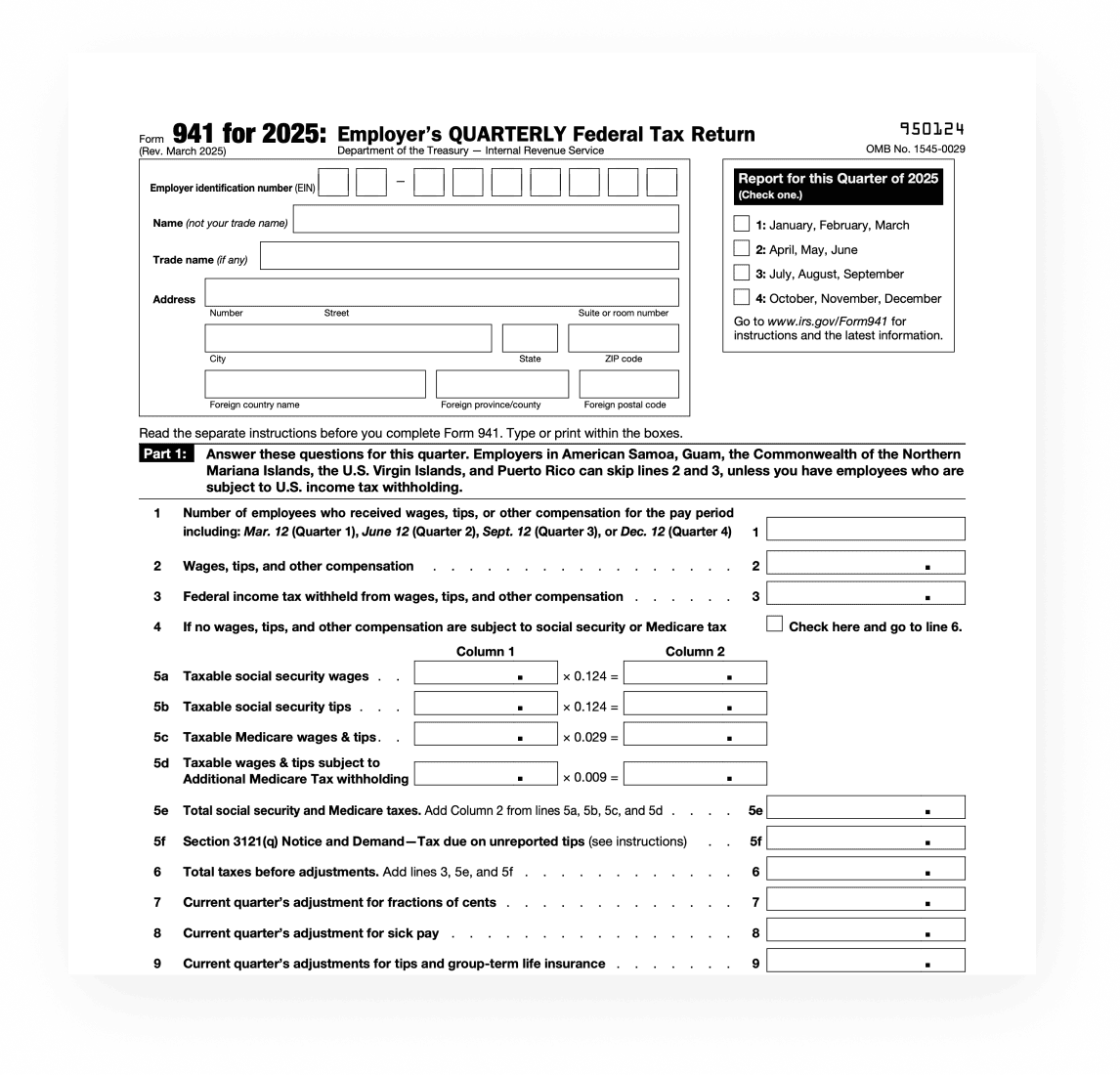

If you’re a business or a non-profit based in the US and you have employees working for you on your payroll, then you are also responsible for withholding their federal income taxes and other taxes that are applicable on the employee’s monthly salary in compliance with IRS policies, such as the Social Security and Medicare tax for 2026. The IRS Form 941 for 2026, officially titled as “Employer’s QUARTERLY Federal Tax Return” is used to file and report the total amount of tax an employer withholds from employees.

If you’re a business or a non-profit based in the US and you have employees working for you on your payroll, then you are also responsible for withholding their federal income taxes and other taxes that are applicable on the employee’s monthly salary in compliance with IRS policies, such as the Social Security and Medicare tax for 2026. The IRS Form 941 for 2026, officially titled as “Employer’s QUARTERLY Federal Tax Return” is used to file and report the total amount of tax an employer withholds from employees.

As the name suggests, the IRS Form 941 is a quarterly form, so you have to prepare and submit this form to the IRS four times a year.

2025 updates:

- Social Security wage base limit is increased to $176,100.

- Social Security and Medicare taxes apply to the wages of household workers who receive $2,800 or more in cash wages in 2025; and to election workers who are paid $2,400 or more in cash in 2025.

2026 сhanges, based on the drafts (to be released in March 2026):

- Aggregate Filers Checkbox: A new checkbox is added for section 3504 agents, Certified Professional Employer Organizations (CPEOs), and other third-party payers.

- Direct Deposit Refunds: Line 15 has been expanded, for employers to apply an overpayment to their next return or receive a refund.

- Tip and Overtime Reporting: The 2026 form and instructions incorporate new reporting for qualified tips and overtime compensation under the OBBBA.

For all the latest updates on the form, please check the IRS website.