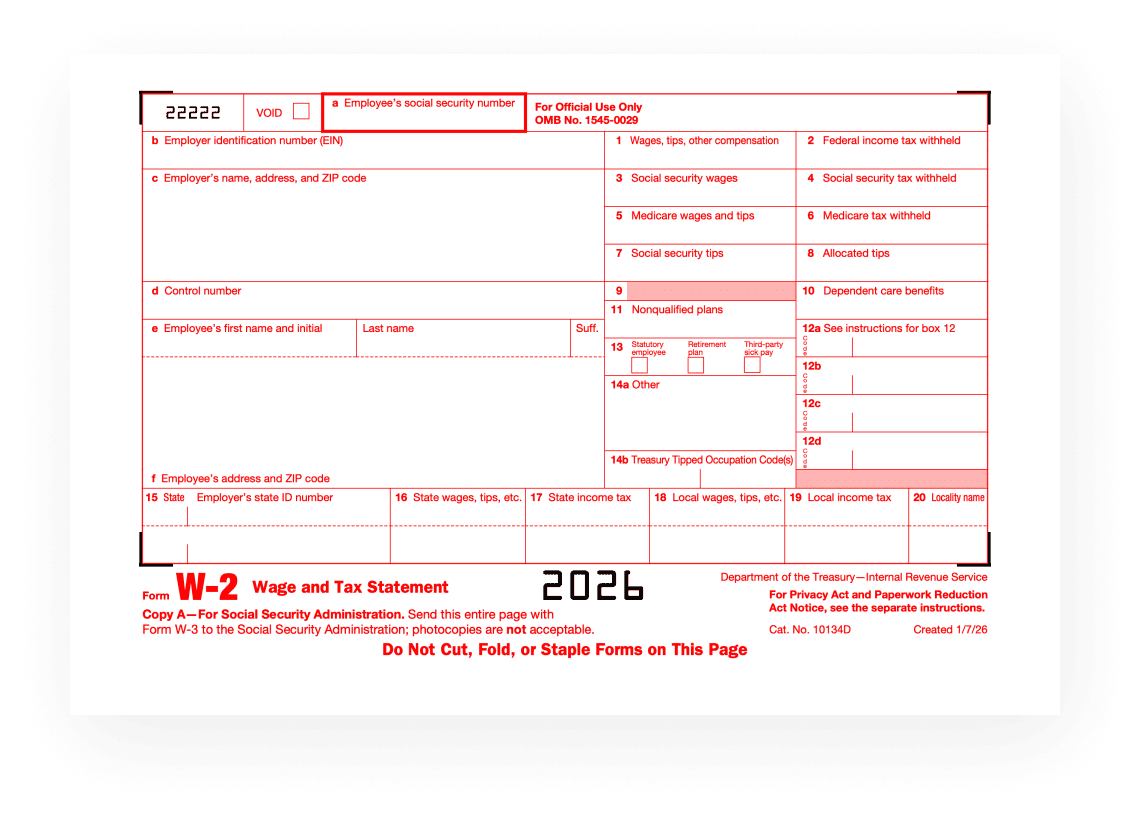

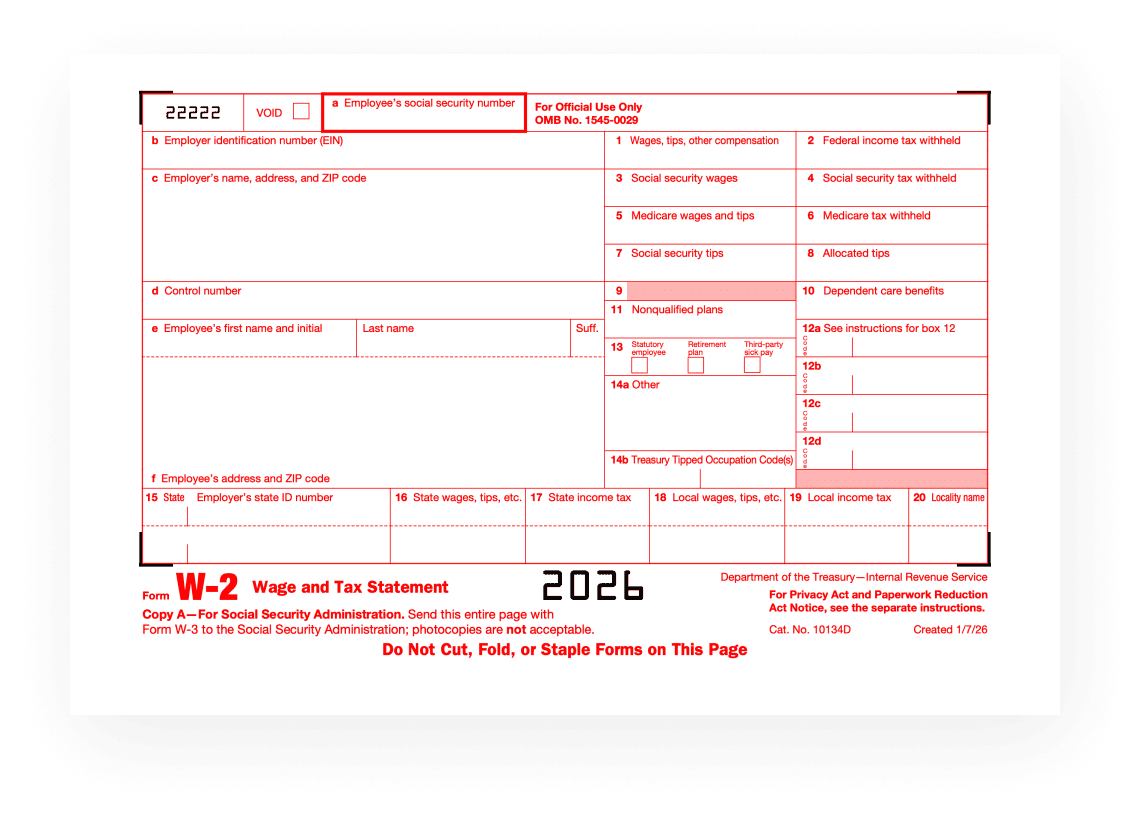

A W-2 Form is an IRS tax form that records each employee's annual wage and the amount of Income, Social Security, or Medicare tax withheld from their pay by the employer. Just like with other IRS forms, filling it out can be a hassle. Here, we'll tell you about where to download W2 form PDF, how to fill it out and common mistakes to avoid.

What is the difference between the IRS Form W-2 and IRS Form W-4?

The W-2 is officially titled as “Wage and Tax Statement” whereas the W-4 is titled “Employee's Withholding Allowance Certificate”. Both these forms are supposed to be filled out by an employee and submitted to the employer. The W-2 form is used for reporting how much an employer paid the employee over the last financial year and how much tax was withheld from his pay. The employer has to submit the W-2 form to the IRS, so that IRS can ensure that the employee paid the necessary taxes.

On the other hand, the W-4 form is filled out by the employee to help his employer calculate the correct amount of federal tax to be withheld from your pay. Every time you change jobs, you have to submit a fresh form to your new employer, so that they can pay you correctly as per the IRS norms.

Always ensure that you’re filling out and submitting the correct tax form for your purpose.

Why do I need the IRS Form W-2?

The IRS Form W-2 is required to be filled out by you and submitted to your employer, so that they can report your earnings as well as the tax that was withheld over the past year, to the IRS. The information you enter in this form tells the IRS whether you paid the correct amount of taxes.

You DO NOT need the form W-2 if you are an independent contractor or freelancer.

When must your employer provide W-2 form to you?

For the federal income tax deadline, your employer is required to give you the W-2 forms by January 31, 2026. If you haven't received your W-2 by this deadline, simply ask your employer for it. You can also call IRS at 800-829-1040; they will either contact your employer to request a missing form or send you a substitute form.

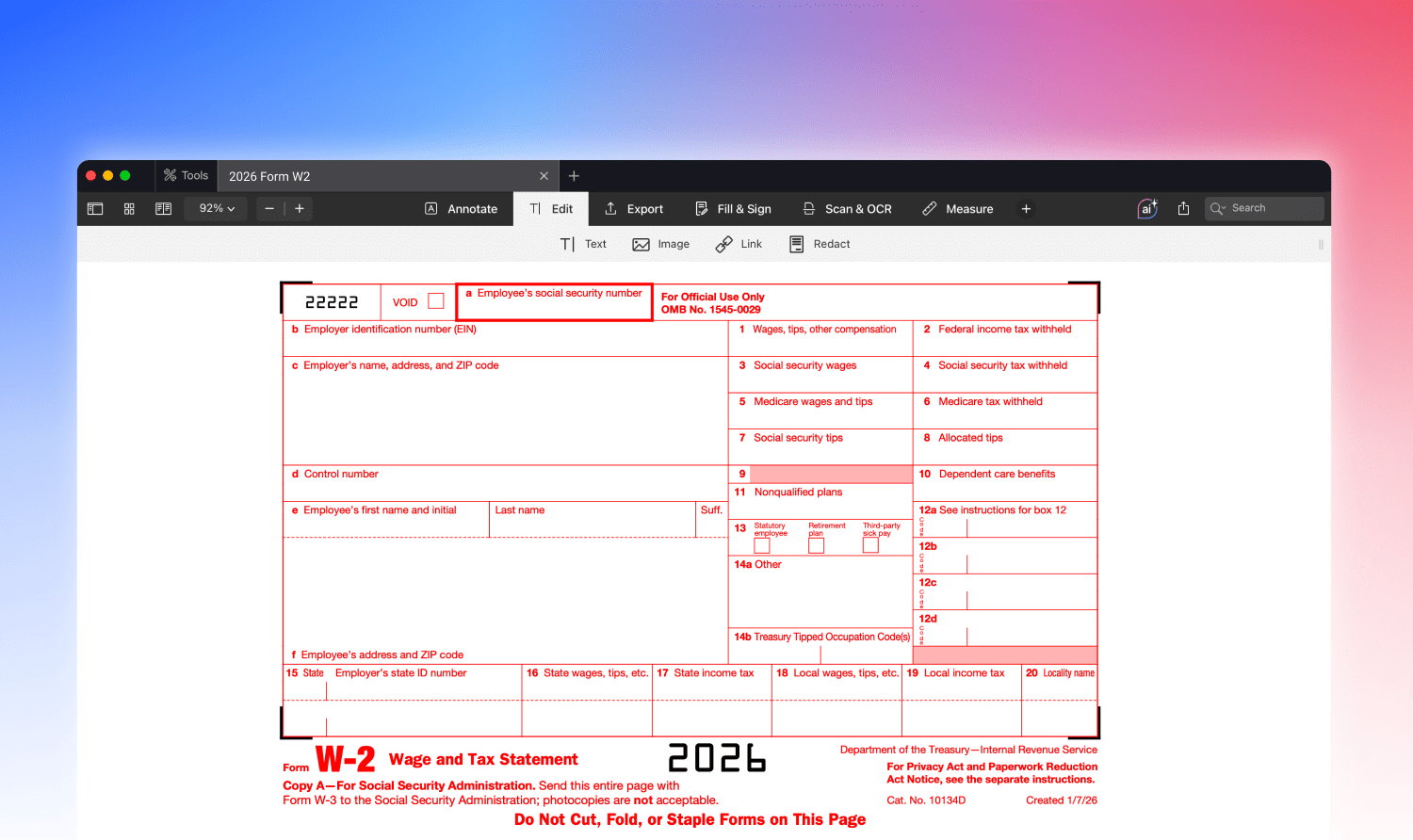

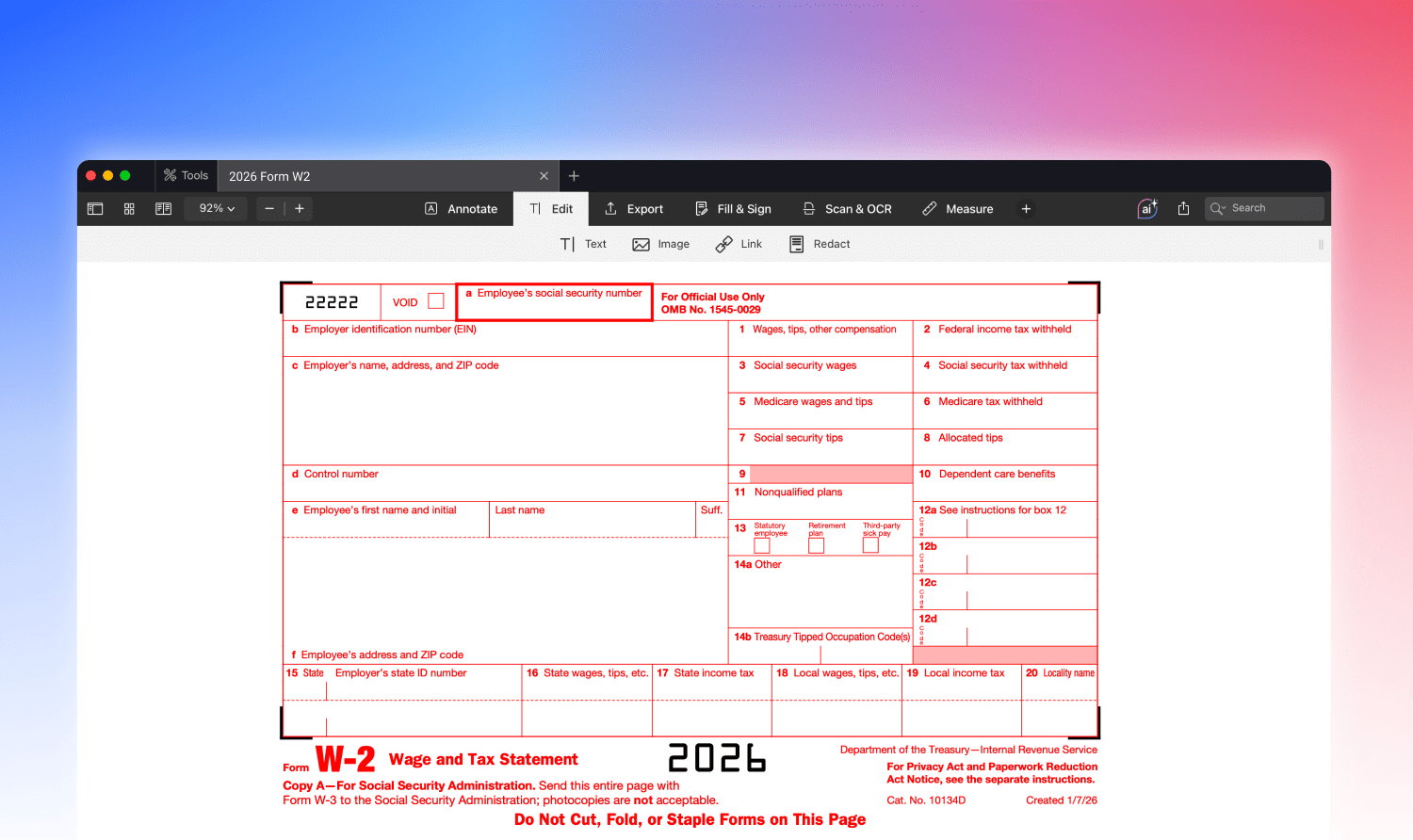

How to fill W-2 Form on Mac?

Follow these simple instructions to fill out Form W-2 on Mac:

- Download the IRS Form W-2 from here.

- Install PDF Expert on your Mac and open page 2 of the downloaded form.

- Type in information about yourself and your employer in the fields ‘a’ to ‘f’ on the left side.

- Type in the information about your wages, tips, and tax withheld in fields ‘1’ to ‘8’ on the right hand side.

- Fill out the rest of the fields carefully, especially field ‘12’. Refer to the instructions behind Copy-C for details.

- Save the form, sign it and send it to your employer.

Sample preview of how to fill W-2 form